Life insurance quote in Portugal

Life insurance in Portugal holds no secrets for Inov Expat, which will be able to guide you to finding the best life insurance for you and your family.

Complete the following form to receive a comparison of the best policies on the market, adapted to your needs :

More information about life insurance in Portugal

In order to be able to choose the right life insurance in Portugal for your needs, you first need to know how it works. Life insurance is personal insurance that covers the risks connected with the insured party’s disability or death. The main purpose of this type of insurance is for the insured party to guarantee their own financial security in the event of a disability and the financial security of their dependents in the event of the insured party’s death.

With this type of insurance, there are 3 possible intervening parties:

The policyholder: the person who signs and pays for the insurance policy

The insured party: The disability and/or death of the insured party are covered and determine the value of the insured capital

The beneficiary: the person who receives an indemnity in the event of the death of the insured party

Even though there are many, we offer explanations below of the two main types of existing life insurance policies:

- Temporary life insurance: a periodic premium is paid for a guaranteed capital in the event of death or disability. The policy is renewed annually and the premium increases every five years based on the insured party’s age.

- Payment protection (or fixed premium) life insurance: a constant premium is paid for a defined term. This type of insurance is mostly used with real estate mortgages.

When is it a good idea to take out a life insurance policy?

- You are the head of household and wish to guarantee your children’s future in the event of your death.

- If you exercise a risky profession, you constantly drive or do any extreme sports.

- You have purchased real estate through a bank loan and wish to guarantee repayment of the loan in the event of an accident or illness.

- You are young and wish to protect yourself against a disability or illness that may affect your professional career.

- You are a key person in your company and wish to guarantee its continuity in the event of your death or disability.

- You are a partner in a company and wish to guarantee other partners the possibility of purchasing your stakes in the event of your death.

These are just a few examples to illustrate the many possibilities of this type of insurance which is the only kind that covers you and your family or those that depend on you.

Don’t think twice about contacting us so we can find the most appropriate life insurance solution for your situation together.

If you’d like to know more about life insurance, we invite you read our article “insuring life" where many of the questions you still may have regarding this very important type of insurance are answered.

Inov Expat

We are an insurance broker that has been working with the best insurance companies in the market since our foundation in 2004 to be able to offer you a life insurance solution that is particularly well adapted to your needs and at the best price. We can answer all your questions as well as handle any claims necessary throughout the term of your life insurance policy and act as privileged liaisons to defend your rights against insurance companies. Our service is free.

Search

Articles

Home Insurance: Policies through your bank

Index

ToggleHome Insurance: Policies through your bank

You’ve just signed a mortgage with your new Portuguese bank and your banking advisor suggests you also take out home insurance at the same time to take advantage of a great interest rate... Is it a good or bad idea?

It’s sure an easy way to finish up all the paperwork (which is cumbersome for everyone!) once and for all. But, it also means quickly forgetting that your commercial relationship with the bank when you sign a mortgage does not require also taking out home insurance with the same bank, even if you’re being lured with a lower interest rate. It’s all a question of common sense and priorities...

If you actually come out winning on the cost of the loan with a “loan/insurance package”, this option may make sense; however, you must still make sure you know what’s included in the home insurance cover signed.

To be honest, insurance offered by banks is often more expensive than the products offered by certain insurance companies. Always compare before signing!

Understanding to make a better choice

If your banking advisor proposes lowering the interest rate subject to signing home insurance with their agency, that means they already have the commercial capacity to offer a lower rate: it’s up to you to negotiate!

Banks have to diversify the products they sell to their customers so they become “locked in”, loyal and less likely to think about switching to the competition due to all the administrative constraints which can be daunting at times. But, bear in mind you also have a commercial relationship with your bank. If you wish to make good choices, it’s always best to take your time and compare offers not only in terms of costs, but, also and above all, the types of guarantees covered by each offer.

Yet, spending time comparing or negotiating is clearly a loss of time for many of us expatriates and we often prefer to accept the packages proposed by our banks.

So, here’s a little advice... Take your time before signing and compare different banks to check the quality of their offers.

Home insurance suggested by your banking advisor is never mandatory, but it can influence the rate on your loan... Even still, make sure you have all the information on the cover offered as well as the prices charged for the same insurance by the competition.

> By now, you probably understand that we advise you to never act too soon on insurance but rather inform yourself well with regard to the prices charged by the competition on the home insurance market in Portugal.

To help you with your loan negotiations, you should know the “real market price” of home insurance: the best way is to seek the advice of a broker.

In fact, in the event of a claim, a broker like INOV Expat is there to file and manage it, find a way to quickly help you (repairs, taxis... depending on the incident, etc.) and, especially when needed, defend your rights as a customer against the insurance company. Note that INOV Expat and all of its collaborators are expatriates: so, they are particularly knowledgeable of your problems and are all multilingual.

So, you’ve got a question about the home insurance you took out with your bank: don’t panic as you’ve got time to compare and you can cancel it upon the renewal date if necessary just like in England!

Why can INOV Expat really help me with my insurance?

You probably now understand that insuring you property means taking the time to ask good questions and compare offers. But, it’s not always so easy to know who to trust with these types of guarantees when you arrive in a new country and haven’t got the time to handle all the administrative issues and even less so when you still aren’t proficient in the language...

INOV Expat - Who are we?

INOV Expat is an insurance brokerage firm aimed at French and English-speaking expatriates in Portugal and Spain, which has signed partnership agreements with the leading insurance companies on the market. We know just how much moving to another country can bring about a lot of surprises and procedures which are sometimes quite complex.

So, ever since its foundation in 2004, INOV Expat has not only aimed to assist its expatriate clients search for “custom insurance” but also defend their rights in the event of a claim.

Ask for your free online quote: automobile, health, home, business, travel, or other insurance. Contact us by email at [email protected] or by phone +351308809541 or WhatsApp (+351) 910 80 8

![]()

Why take out Travel Insurance?

Index

ToggleWhy take out Travel Insurance?

Traveling is about having adventures... But, sometimes there are troubles too: flight cancellations and delays, lost luggage, a stolen passport, health issues... Whether on business or traveling for pleasure, a trip abroad can become a nightmare with major unexpected costs.

Travel insurance is all about taking off with peace of mind

There are several formulas that cover the following risks in particular:

- Medical, surgery and hospitalisation fees up to €100,000

- Unlimited repatriation costs

- Other options may cover lost luggage, trip cancellation costs, dental emergencies and civil liability abroad (including material damages and bodily harm) caused to third parties during your stay

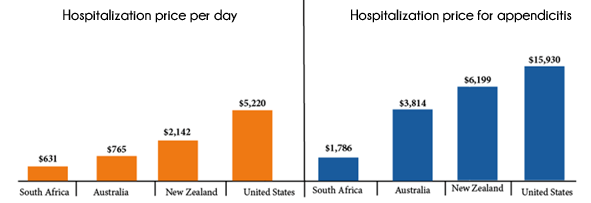

Here are two examples of healthcare costs at different destinations:

We always advise you to adapt your travel insurance policy to your “traveller” profile:

- For those who worry more about medical care (covering medical costs while traveling as well as repatriation), you should choose a medical care

- For travellers looking for expanded cover for all risks during travel, then multi-risk travel insurance should be the choice

- Travel insurance plans are custom-designed and adapt to your needs, whether a short or long stay or a business, family or adventure trip

From the duration to the type of stay to the adapted guarantees, there are so many different options based on your destination and coverage needs. For frequent travellers and those who’d like to insure all the members of their family, there are also annual and family plans.

Our advice when it comes to travel insurance: don’t act too quickly and take time to analyse the cover offered in relation to your “traveller” profile !

What are the covers and benefits of annual travel insurance?

This is the most complete travel insurance. It particularly covers the following:

- Medical costs abroad (medical care, surgery and hospitalisation) up to €100,000

- Emergency dental care

- Repatriation or medical transfers without any cost ceilings

- Extended stays due to illness or an accident

- Travel and accommodation fees for a family member in the event of an illness or accident

- An early return in the event of the death or the non-scheduled hospitalisation of a close family member

- Luggage search and delivery if lost

- Interpreter services for an emergency situation

What is the price for... annual travel insurance?

To travel with complete peace of mind, we strongly advice taking out a travel insurance policy... When the average cost of travel insurance for 15 days is €50, it seems quite reasonable to include this cost in your holiday budget.

Irrespective of the duration of your trip, your destination or the number of people to be insured, we’re there to find the best travel insurance for you.

INOV Expat - Who are we?

INOV Expat is an insurance brokerage firm aimed at French and English-speaking expatriates in Portugal and Spain, which has signed partnership agreements with the leading insurance companies on the market. We know just how much moving to another country can bring about a lot of surprises and procedures which are sometimes quite complex.

So, ever since its foundation in 2004, INOV Expat has not only aimed to assist its expatriate clients search for “custom insurance” but also defend their rights in the event of a claim.

Ask for your free online quote: automobile, health, home, business, travel, or other insurance. Contact us by email at [email protected] or by phone +351308809541 or WhatsApp (+351) 910 80 8

![]()

Health Insurance in Portugal: How It Works

Index

ToggleHealth Insurance in Portugal: How It Works

Beyond the tax benefits for pensioners, Portugal is attracting more and more European workers who are coming to work, develop a business and enjoy an excellent quality of life and some of the best sun in Europe. Some 500,000 French workers have chosen this new life as counted at the beginning of 2018, which is 5 times more than recorded in 2014! Yet the tempting adventure of expatriation also comes with certain administrative hassles and the issue of medical coverage should always get careful attention. In fact, the Portuguese healthcare system may be disconcerting to the English, who are used to a bit of freedom of choice when it comes to doctors and possible reimbursement even when using the private system. How does the Portuguese healthcare system work?

Are there any links between the private and public healthcare systems like in England?

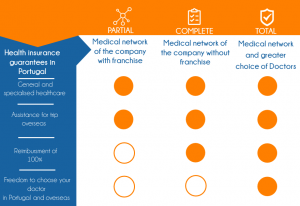

Partial Cover

This is the basic formula which allows access to an insurance company-approved network of doctors with a small payment per service (deductible) for:

- general medicine or specialist consultations,

- hospital care,

- healthcare when traveling abroad.

Full Cover

With this formula, patients have access to the company’s medical network without any deductibles: consultations are 100% covered by the company and the insured also benefits from travel insurance when abroad.

Complete Cover

This is the most expensive type of policy but also the one that guarantees the best cover for your and your family’s health in Portugal! And depending on your needs, complete cover is an investment that can be quickly returned. In fact, besides giving you access to a large network of practitioners approved by the insurance company in general and specialist medicine, this health insurance particularly ensures 100% payment of all visits and offers hospital care as well as travel assistance when abroad.

And if a physician outside the company’s network must be consulted either in Portugal or abroad, 80% of the advance fees will be covered by the company.

If you’re not very comfortable speaking Portuguese or are hesitant to express yourself in another language when discussing a healthcare issue, the COMPLETE policy is just for you: it allows access to English-speaking generalists and specialists. The COMPLETE policy also covers alternative medicine consultations: acupuncture, homeopathy, osteopathy are some of the rather costly practices covered by this policy.

Imagen de rawpixel.com en Freepik

INOV Expat - Who are we?

INOV Expat is an insurance brokerage firm aimed at French and English-speaking expatriates in Portugal and Spain, which has signed partnership agreements with the leading insurance companies on the market. We know just how much moving to another country can bring about a lot of surprises and procedures which are sometimes quite complex.

So, ever since its foundation in 2004, INOV Expat has not only aimed to assist its expatriate clients search for “custom insurance” but also defend their rights in the event of a claim.

Ask for your free online quote: automobile, health, home, business, travel, or other insurance. Contact us by email at [email protected] or by phone +351308809541 or WhatsApp (+351) 910 80 8

![]()

Guide to Home Insurance in Portugal

Index

ToggleGuide to Home Insurance in Portugal

You’ve made the decision. You’re moving to Portugal and are going to take total advantage of its relaxed way of life, sun, beaches, golf courses... But before going any further, it’s best to have all the administrative issues straight like home insurance! Whether you’re renting or own your new home, you must ask yourself a few good questions in order to insure it: “What’s the process? What’s the cost? With who? Read our Guide to Home Insurance in Portugal for the answers.

Why get home insurance in Portugal?

Because, just like when you’re in England, your new home won’t be completely safe from a leak, a burglary or a weather event that may damage the structure and/or the property in your home...

Whether an owner or tenant, home insurance brings peace of mind: it guarantees the structure of your home as well as your possessions in addition to covering the civil liability of the occupants and even that of your 4-legged friends!

I heard home insurance is not mandatory in Portugal

That’s true... As a tenant in Portugal, you have no obligation to take out home insurance. However, home owners are required to insure their assets against the risk of fire and the property manager must ensure the common areas are covered by insurance.

So, why should I insure my home in Portugal if it’s not mandatory?

For peace of mind and to guarantee peaceful relations with your neighbours and with your landlord!

In fact, no one is completely safe from a burglary or a “minor everyday accident” (an overflowing bathtub, a leaking washing machine...) that may damage your home as well as your neighbours’ homes. When that happens, who pays for the repairs and at what cost? Without home insurance, you may quickly find yourself in a conflictive situation and you still may not really be proficient in your host country’s language! Insuring your home is all about investing in a guarantee of peace, especially when you’re abroad.

What other benefits are there to home insurance?

Home insurance is much more than just insuring your furniture … In fact, home insurance is also known as home multi-risk. This means it covers all sorts of risks ranging from breaking and entering to fire, water damage and electrical damage following a big storm... And even Civil Liability (CL) for the insured and the people declared under the same roof.

Civil Liability covers all bodily injuries and material and non-material damages caused to another person in one’s private life.

Did you know?

In Portugal, it is quite easy to find qualified domestic help at a much lower cost than in England: cleaners, childcare, gardeners, etc. But, did you know that you are required to take out occupational accident insurance to cover your employees when working in your home as well as when they’re traveling to and from work?

Get more information from our INOV Expat specialists...

To better understand your premium, you need to know how it’s calculated and ask a few good questions :

-

Do you rent or own your home in Portugal?

If you’re the home owner... The premium is generally higher as the cover is broader: it even includes structural insurance, for example. If you’re the home owner and occupant, insurance may also cover the furniture.

-

Is it your primary or secondary residence?

If it’s a secondary residence which is only occupied a few weeks a year, the premium will be higher! In fact, the risk of a potential theft increases when your property has no surveillance or occupants for long periods of time and that is why the premium is higher. Other factors will also influence the cost of the premium: the surface area of the home, outbuildings, a swimming pool...

-

Where do you live?

Your place of residence has a significant impact on the cost of your premium. Insurance companies cover risks by calculating based on objective statistical data as far as the number of reported violations in the surrounding area. The premium should be less in a rural area in comparison to a home in an urban area.

-

Is it a house, a flat... big or small?

The premium for your home insurance is calculated based on the number of rooms to be insured. For example, a studio flat in the Chiado district in Lisbon would be less expensive to insure than a family home with a swimming pool and an outbuilding in Cascais or Faro since the risk of damage is statistically lower... Insurance companies also take into account the value of the fixed assets (owner) and non-fixed assets (tenant) at the property to be insured.

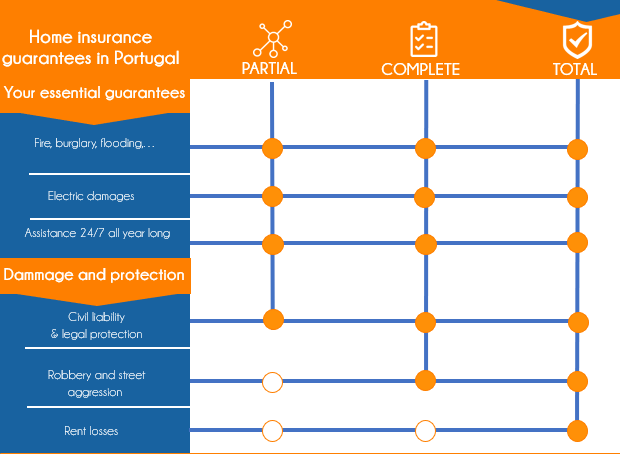

To get an idea of the different offers, here’s a little diagram with the 3 main types of home insurance policies you may find in Portugal :

What about buying a home... is it really all that complicated in Portugal?

Rather than renting, you’d prefer to take advantage of the buoyant estate situation and relatively affordable prices by investing in a new home...

The various steps:

-

Get assistance from a professional

Finding a local representative (an attorney, an agent broker or a Portuguese notary) is essential given the various steps that must be taken if you wish to buy and even more so if you aren’t proficient in Portuguese.

-

Conservatora do registo Predial

Once you’ve found your dream home, the land registry (Conservatora do registo Predial) must be checked to ensure the ownership status is correct without any burdens or mortgages that may get in the way of the sale.

-

Get a Taxpayer’s Number (Finanças)

This is a card that shows your taxpayer’s number. This document is essential to pay your annual property taxes but also for certain everyday tasks like opening an account with a Portuguese bank.

-

Cadastre (Carderneta Predial)

It is important to check with the local cadastre to ensure all the information registered corresponds with the information you’ve been given - number of rooms, surface area of the property, surface area of the garden, etc.

-

Promise to Sell (Contracto de Compra e Venda)

At this point, you’ll probably need to pay the seller (via their attorney) a deposit of 10% of the purchase price. The corresponding contract may be signed before a notary or an attorney.

-

Transfer duties= IMT (formerly known as SISA)

IMT is the Portuguese property transfer duty and it must be paid before signing the bill of sale. The sum varies based on the property value.

- Property taxes (IMI)

Careful! Before signing any actual bill of sale, you must have your attorney or representative verify the seller is current on property taxes (for the last 5 years) … or you’ll be at risk of having to pay them yourself.

- Definitive bill of sale (Escritura)

The land patent is issued along with the definitive bill of transfer which is signed at a notary’s office.

- Registration

The transfer of ownership must be registered with the local land registry so your name is listed as the new owner.

INOV Expat - Who are we?

INOV Expat is an insurance brokerage firm aimed at French and English-speaking expatriates in Portugal and Spain, which has signed partnership agreements with the leading insurance companies on the market. We know just how much moving to another country can bring about a lot of surprises and procedures which are sometimes quite complex.

So, ever since its foundation in 2004, INOV Expat has not only aimed to assist its expatriate clients search for “custom insurance” but also defend their rights in the event of a claim.

Ask for your free online quote: automobile, health, home, business, travel, or other insurance. Contact us by email at [email protected] or by phone +351308809541 or WhatsApp (+351) 910 80 8

![]()

Healthcare in Portugal

Index

ToggleHealthcare in Portugal

Pursuant to European provisions, English expatriates residing in Portugal shall be exclusively assigned to the Portuguese social security system and will, therefore, lose status as insured under the English system.

Two healthcare systems co-exist in Portugal: the public healthcare system Serviço Nacional de Saúde (SNS), for the employed, pensioners and non-employed, and the private healthcare system.

No one is sure to be free of a raging toothache, a sprain or a young child’s high fever... so it’s time for a little information on the procedures all new residents must complete before a real need arises and to help you better understand the Portuguese public healthcare system!

Before anything else: register!

To benefit from SNS services, you must register with the health centre (centro de saúde) that corresponds to your place of residence to get a health card (cartão de utente do SNS). To do so, you must go the reception desk with some form of official identification, your English health insurance card and proof of residency in Portugal. These health centres are the equivalent of community health centres and it’s where you will be assigned a family or primary care physician.

How do you get an appointment with your family doctor?

Consultations are at the health centre and you may schedule appointments with your doctor by phone (the number found on your health card). If you are too ill to go to work and your primary care physician is not available, you must go to your health centre to see the on-call doctor.

If you need to see a specialist, how do you do it?

For any consultation with a public sector specialist, you first need to see your primary care physician at your health centre who will determine whether or not you need to see a specialist. If your primary care physician decides, you will be referred to a public sector specialist and given a document indicating the appointment day and time and the specialist’s contact details.

Important to know! Waiting lists

Waiting times to see general medicine doctors and specialists are often long in the public system and can even take several months in the case of specialists or complex tests and treatments. Private insurance allows you to save time and get an appointment very quickly. They offer direct access to all specialists and in-depth examinations without going through a general medicine doctor first.

There are many types of policies and different insurance companies which can make the decision difficult. We advise you to call a broker who will compare the different options from the various insurance companies for you. Brokers can even secure conditions that you would not otherwise have direct access to and will search for the insurance that best meets your needs.

Read our guide to healthcare for more details: INOV Expat Portugal Guide to Healthcare

> More information on protection: Healthcare System in Portugal: How It Work

INOV Expat - Who are we?

INOV Expat is an insurance brokerage firm aimed at French and English-speaking expatriates in Portugal and Spain, which has signed partnership agreements with the leading insurance companies on the market. We know just how much moving to another country can bring about a lot of surprises and procedures which are sometimes quite complex.

So, ever since its foundation in 2004, INOV Expat has not only aimed to assist its expatriate clients search for “custom insurance” but also defend their rights in the event of a claim.

Ask for your free online quote: automobile, health, home, business, travel, or other insurance. Contact us by email at [email protected] or by phone +351308809541 or WhatsApp (+351) 910 80 8

![]()

Guide to Health Insurance in Portugal

Index

ToggleGuide to Health Insurance in Portugal

Unlike in England where the two healthcare systems (public and private) co-exist with patient freedom of choice and guaranteed minimum cover by the social security system, the SNS (Servicio nacional de Saùde) in Portugal never reimburses private sector healthcare. In order for care to be covered by the Portuguese social security system, patients must always respect the treatment plans imposed by their primary care physician: private consultations are never covered, not even partially, by the Portuguese social security system.

How does the Portuguese public healthcare system work in?

1. Where can you get public medical care?

All Portuguese residents, even expatriates, are assigned a health centre (centro de saude) near their home. The equivalent of our EHIC (European Health Insurance Card) will be issued upon registration (passport + EHIC certificate+ proof of residency in Portugal) and a primary care physician will be assigned.

2. Can you choose your own doctor?

No, in Portugal (just like in Spain) patients in the public healthcare system do not choose their own primary care physician as one is assigned upon registration at their health centre. This doctor is the referring physician for your family and can provide access to consultations with specialists, always within the public sector.

3. What do I do if my primary care physician is not available?

If your primary care physician is not available, you must still go to your health centre. Only the reception personnel there may secure you an appointment with another doctor or on-call physician. Outside your health centre opening hours or in the event of an emergency, patients may go the closest permanent care service centre (Serviço de Atendimento Permanente, SAP) or hospital: the integrated medical emergency system may be contacted by calling 112 or the medical emergency number 808 242 424.

4. How can you get an appointment with a specialist?

The primary care physician designated upon registration at a health centre is the only person authorised to refer you to a specialist doctor: if the primary care physician believes the symptoms require an opinion from a specialist after an initial appointment, you will be referred to one designated by your primary care physician who will supply you with all the necessary documents.

Private healthcare insurance in Portugal... what is it for?

1. No more waiting

Accessing care more quickly than in the public sector is possible with private sector physicians who are not subject to any agreed rates (as is the case in England).

2. Choosing your own doctor

Investing in health insurance in Portugal means guaranteeing your choice of doctor, less waiting times for treatment and, above all, having direct access to specialists.

3. Other advantages

Depending on your needs and the option chosen, your health insurance may offer you access to convenience healthcare services (acupuncture, podiatrists), for example, or even dental care, orthodontists and eye doctors.

4. + ... all in English

Not yet bilingual in Portuguese or just not comfortable speaking about healthcare issues in a language you’re not fully proficient in... no worries... INOV Expat has selected a list of English-speaking doctors! Don’t think twice about speaking to our advisors.

What are the differences between the public and private systems?

There are 3 types of health insurance policies offered by companies:

Comparing them in order to choose your health insurance in Portugal... that’s INOV Expat’s job.

Age, occupation, medical history and the number of people to be insured in your household as well as the expected cover level are all factors considered by insurance companies when calculating your health insurance premium in Portugal. In order to best adapt your health insurance in Portugal, it is important to speak to professionals who can offer personalised advice. And for even more peace of mind, in addition to free advice from our specialists, INOV Expat always commits to offering 3 quotes from different companies!

A healthcare tip from INOV EXPAT: the Health Card

Why get health insurance in Portugal?

As explained, although the public healthcare system in Portugal offers quality care, it requires being very patient and does not allow free choice of doctors. In order to avoid stressful waits and be able to see the doctor of your choice, choose a hospital or clinic and benefit from faster medical services (especially for emergencies), choose private health insurance. Besides your Portuguese social security card, you will receive a health card from the insurance company.

This health card offers a number of benefits.

- No advance medical payments if you see a doctor in the company’s medical network.

- Private rooms when hospitalised are no longer a luxury with your card.

- When traveling abroad, your health insurance card will allow access to repatriation and travel insurance services.

INOV Expat - Who are we?

INOV Expat is an insurance brokerage firm aimed at French and English-speaking expatriates in Portugal and Spain, which has signed partnership agreements with the leading insurance companies on the market. We know just how much moving to another country can bring about a lot of surprises and procedures which are sometimes quite complex.

So, ever since its foundation in 2004, INOV Expat has not only aimed to assist its expatriate clients search for “custom insurance” but also defend their rights in the event of a claim.

Ask for your free online quote: automobile, health, home, business, travel, or other insurance. Contact us by email at [email protected] or by phone +351308809541 or WhatsApp (+351) 910 80 8

![]()

How does the private healthcare system work in Portugal?

Index

ToggleHow does the private healthcare system work in Portugal?

Just like in Spain and Great Britain, there are 2 healthcare systems that co-exist in Portugal: the public and the private healthcare systems. Thanks to European cooperation agreements, English expatriates may benefit from the Portuguese public healthcare system based on universal and nearly-free care. However, those who’d like to choose their doctors and avoid waiting lists look to the private healthcare system which, unlike with the English private system, do not have agreed rates partially paid by the "Social Security" system. For a better understanding, we suggest reading this quick introduction to private health insurance and how it all works.

What are the differences between the two healthcare systems in Portugal?

Each Portuguese resident must register with the Portuguese Social Security (SNS) office nearest their home: generally, it’s the health centre (community clinic) where any future general medicine consultations take place. The public healthcare system is basically free yet imposes a primary healthcare provider on each patient who must be consulted for all general medicine needs as well as before seeing any specialist in order to obtain a referral. General medicine appointments are of fairly easy access in urban areas; nevertheless, the waiting times can sometimes be quite long to see a specialist or get an operation... so much so, they often discourage many ill patients!

The private healthcare system was, therefore, developed to mitigate the failures of the public system which is of good quality yet has greatly felt the effects of the economic crisis. The private healthcare system operates on free pricing which is sometimes a deterrent to patients... Thanks to private health insurance policies that guarantee good reimbursement cover, more and more people are turning to private medical consultations in order to freely choose their own doctors and avoid penalizing waiting times.

What are the covers?

Private health insurance in Portugal not only allows access to hospitalisation but also a network of generalist doctors and specialists approved by the insurance company for consultations without any advance fees. Depending on the chosen option, you may have access to “convenience” consultations like acupuncture, podiatry and some dental care.

And for those who still aren’t very proficient in Portuguese: insurance companies can suggest English-speaking doctors. Upon taking out a private health insurance policy, you will not only have a Portuguese social security card but also a private health insurance card for the insured and all beneficiaries.

What are the different private healthcare insurance options?

Before taking out a health insurance policy, you must ask yourself a few good questions to properly identify your and your family’s needs. Insurance companies offer different insurance formulas that can adapt to each one’s needs and financial situation... there are 3 major categories:

Partial Cover

This is the basic formula which allows access to an insurance company-approved network of doctors with a small payment per service (deductible) for:

- general medicine or specialist consultations,

- hospital care,

- healthcare when traveling abroad.

Full Cover

With this formula, patients have access to the company’s medical network without any payments per service as consultations are 100% covered by the company and the insured benefits from travel insurance.

Total Cover

With this “premium” cover, the insured always have access to the company’s medical network and benefit from 100% cover without any advance payments using the insurance card. However, if someone with “total cover” wishes to consult a practitioner, generalist doctor or specialist outside the company’s network either in Portugal or abroad, 80% of the advance fees will be covered by the company.

How do you get a health insurance policy?

You may sign a health insurance policy in just 24 hours. It is absolutely necessary to identify your needs well and compare the different quotes to move on to the medical questionnaire phase (on paper or by phone). Whenever you take out health insurance in Portugal, you must provide identification (passport or residence card), a mailing address and a Portuguese bank account number.

Any new health insurance policy taken out in Portugal imposes a waiting period before the cover can be applied (except life-threatening emergencies which are never subject to waiting periods).

-6 to 8 months for surgeries and hospitalisation

-8 months for childbirth

Except for childbirth, most of these waiting periods can be decreased or even waived if you were already covered by health insurance before signing the new policy. You simply need to provide your broker with a copy of your old contract and proof of the most recent payment. Please note that the period between cancellation of the old policy and signing the new health insurance policy in Portugal must be exceed 30 days.

INOV Expat - Who are we?

INOV Expat is an insurance brokerage firm aimed at French and English-speaking expatriates in Portugal and Spain, which has signed partnership agreements with the leading insurance companies on the market. We know just how much moving to another country can bring about a lot of surprises and procedures which are sometimes quite complex.

So, ever since its foundation in 2004, INOV Expat has not only aimed to assist its expatriate clients search for “custom insurance” but also defend their rights in the event of a claim.

Ask for your free online quote: automobile, health, home, business, travel, or other insurance. Contact us by email at [email protected] or by phone +351308809541 or WhatsApp (+351) 910 80 8

![]()

What exactly is a brokerage firm?

Index

ToggleWhat exactly is a brokerage firm?

Some ideas are hard to let go of... in insurance too!

Many still believe “a broker obviously gets a commission as payment... so, I hardly see the point as it will be more expensive; just go directly to the insurance company! And their offer will obviously be less extensive than a legit insurance company“

But, that’s all completely wrong!!

If you want a “custom” insurance solution, it’s much better to go knocking on an insurance broker’s door as they can choose from among all their partners to offer you insurance with the best quality/price ratio.

Did you say an insurance broker?

Brokers are above all insurance professionals who use all their skills and market knowledge to help their clients: they work as intermediaries with insurance companies. Brokers are fully independent of insurance companies unlike sales reps, company employees and agents. This independence means brokers have more objective perspectives when advising their clients on a rather richer offer that will adapt better to their specific needs and at just the right price. Brokers manage the client relationship from A to Z, particularly guiding them to define their needs, orienting them towards the most well-suited insurance company offer and then managing all administrative aspects of the contract including filing claims. While agents work with fixed goals set by the company they represent and promote that company’s products , brokers represent their clients. The rates provided by a brokerage firm are identical to those applied by insurance companies in other distribution channels (internet, sales reps, agents...), but there’s more choice! INOV Expat works with more than 20 leading insurance companies on the market to find the most competitive prices.

In the event of an incident, who do I call?

An accident, a leak... call your broker. They will manage everything for you! In fact, a brokerage firm offers comprehensive services ranging from the initial document gathering for your insurance application and filing claims with the company to sending a service provider to repair your leak, for example. And, don’t forget another important task performed by a broker: ensuring your rights and making sure the company fulfils all of its obligations under the contract in the event of an incident. The volume of contracts a broker manages not only provides for powerful negotiation but also certain neutrality: a broker is truly a client’s ally and guarantees the client’s rights will be defended in any situation.

And what if my premium goes up?

The price of your insurance may go up because of objective factors such as a higher accident rate, the depreciation of the insured property, an increased insured risk or even adjustments to the consumer price index. However, increases can also sometimes be “opportunistic” and unjustified: that is another benefit of choosing an insurance broker! In fact, in such cases, brokers as insurance market professionals know how to advise and guide you towards other offers or can renegotiate a lower premium on your behalf with the insurance company. When you buy insurance through the habitual sales channels (internet, an agent, direct from the insurance company), it is much more difficult to argue a premium increase or renegotiate!

So, how does a broker earn money?

Brokers are compensated with commissions paid by the insurance companies based on the number of sales made.

INOV Expat - Who are we?

INOV Expat is an insurance brokerage firm aimed at French and English-speaking expatriates in Portugal and Spain, which has signed partnership agreements with the leading insurance companies on the market. We know just how much moving to another country can bring about a lot of surprises and procedures which are sometimes quite complex.

So, ever since its foundation in 2004, INOV Expat has not only aimed to assist its expatriate clients search for “custom insurance” but also defend their rights in the event of a claim.

Ask for your free online quote: automobile, health, home, business, travel, or other insurance. Contact us by email at [email protected] or by phone +351308809541 or WhatsApp (+351) 910 80 8

![]()

Mutual benefit health insurance in Portugal

Index

ToggleMutual benefit health insurance in Portugal

You’ve arrived in Portugal: a new life, new plans... but an allergy or a bad sunburn can easily remind you that you’re not safe from a little weakness health-wise. To get the most out of your new expatriate life, it’s better to understand the Portuguese healthcare system which is quite different from the English one and, above all, decide whether a mutual benefit insurance plan or private health insurance in Portugal could offer you and your family a little peace of mind! INOV Expat offers this advice…

Why choose mutual benefit health insurance in Portugal?

The Portuguese public healthcare system is ranked 12th on a list of the best healthcare systems in the world, according to the most recent WHO survey. Based on the principle of universal and nearly-free access to healthcare, it offers good quality care and cover, but the waiting times can be quite long! The economic crisis hit public healthcare policies in Portugal hard: public hospitals are short of personnel and overburdened, basic care is not always available outside large urban areas and consultations with specialists almost always take place in large cities, sometimes forcing people to travel many kilometres to see one. So, for an English expatriate who is accustomed to freely choosing their primary care physician and rather quick access to treatment, it is sometimes disconcerting to have a referring doctor imposed on you and particularly to have to wait for care: it’s not very easy to be calm and patient when you have a feverish, crying child with you in a crowded waiting room!

Choosing a mutual benefit health insurance policy in Portugal means freeing yourself of the constraints imposed by the public healthcare sector; namely, the lack of choice in family doctors, waiting lines…etc. In fact, with your mutual benefit private healthcare, you will be able to freely access networks of doctors approved by your insurance company who can be consulted without paying any advance fees in addition to convenience consultations like prevention check-ups, alternative medicine (acupuncture...) and even dental services.

Who is actually behind your mutual benefit health insurance?

These private healthcare insurance products are provided by the largest insurance companies and you can contact these companies directly to get an idea for what they offer; however, a broker like INOV Expat will be able to advise you for free (in English!) and, above all, give you a real comparison of the best products on the market. Brokers process so many contracts that they can secure competitive sales offers in terms of price in comparison to the very same insurance product purchased directly.

Who are mutual health insurance policies for?

Anyone who lives in Portugal looking for certain peace of mind when it comes to their health as well as excellent cover! A policy may be signed by a company (group contract) or an individual who would like to be insured along with his/her family. In any case, beneficiaries must all be individually named in the contract.

How do you know which to choose when there are so many mutual insurance offers available?

Mostly by asking good questions...

What they of healthcare cover do you need besides the traditional guarantees (hospitalisation, treatment for illnesses and accidents)? Do you plan on frequently traveling abroad... Are you covered... Do you have valid travel assistance?

To help you answer all these questions, INOV Expat, your broker in Portugal and health insurance market specialist, is in the best position to advise you for free based on the specific needs of your family and the monthly amount you’re able to pay for your healthcare…

INOV Expat - Who are we?

INOV Expat is an insurance brokerage firm aimed at French and English-speaking expatriates in Portugal and Spain, which has signed partnership agreements with the leading insurance companies on the market. We know just how much moving to another country can bring about a lot of surprises and procedures which are sometimes quite complex.

So, ever since its foundation in 2004, INOV Expat has not only aimed to assist its expatriate clients search for “custom insurance” but also defend their rights in the event of a claim.

Ask for your free online quote: automobile, health, home, business, travel, or other insurance. Contact us by email at [email protected] or by phone +351308809541 or WhatsApp (+351) 910 80 8

![]()

Motorbike Insurance in Portugal : Know and Understand All the Ins and Outs

Index

ToggleMotorbike Insurance in Portugal : Know and Understand All the Ins and Outs

Avoid the traffic jams, enjoy the exceptional sun and excellent quality roads... with a love for speed, you know your motorbike will be your preferred means of transport in Portugal whether travelling to work or getting away on the Marginal Road headed towards Cascais!

But, in order to fully enjoy your bullet bike, you’d better be well-insured whether you just wish to cover your mandatory minimal civil liability obligations or you want more complete insurance that covers theft, for example.

Portuguese law of 13 August 2009, known as “lei dos125” has significantly changed motor traffic in Portugal by increasing the number of 2-wheelers on the roads as well as the number of accidents! In fact, after that date, anyone over the age of 25 in possession of a valid driving licence is permitted to ride a motorbike up to 125 cc. The current government plans to further modify this law by introducing a practical exam before being able to ride a motorbike... and, therefore, better control the number of accidents on the roads.

The motorbike insurance offer in the Portuguese market has been greatly beefed up since 2009, to cover these more exposed drivers.

Is motorbike insurance mandatory in Portugal?

Yes, insuring your motorbike is mandatory with at least what is known as “third-party” insurance: it doesn’t cover damages to the responsible party’s vehicle in the event of an accident; it only covers the damages caused to third parties travelling on a public road. This option may seem to be sufficient if your motorbike is rather old or you only use it occasionally (at weekends, for example).

Can I loan my motorbike to someone?

As in all automobile insurance policies, there’s a mandatory clause covering a second driver or occasional driver who is not specifically named in the policy. If you loan your bike, you must nonetheless make sure the driver you loan your two-wheeler to is older than 25 and has had a driving licence for more than 2 years in order to benefit from the same cover as you do.

All-risk insurance: what does it cover?

- Mandatory civil liability

- Theft and fire. Since motorbike theft is much more common than car theft, all-risk insurance insures this risk as well as fire.

- All-accident damages: you are covered even if you’re responsible for the accident

- Collision damage: because you may collide with another vehicle on the road or an animal or pedestrian, this guarantee covers you in all of these circumstances.

- Roadside assistance

All-risk insurance... are you still covered if you have an accident?

YES. All-risk insurance even covers you if you are responsible for the accident.

But, be aware. If you cause the accident and are under the influence of alcohol or drugs, no insurance company will pay any indemnities for your bodily injuries or material damages (even if you’re the only one injured). Only damages to third parties will then be covered.

Attention…. police controls are rather common in Portugal, especially if your registration plates have not yet been exchanged. So, be careful as your motorbike insurance does not protect you from fines for speeding or driving drunk (0.5 g/L in Portugal)!

INOV Expat - Who are we?

INOV Expat is an insurance brokerage firm aimed at French and English-speaking expatriates in Portugal and Spain, which has signed partnership agreements with the leading insurance companies on the market. We know just how much moving to another country can bring about a lot of surprises and procedures which are sometimes quite complex.

So, ever since its foundation in 2004, INOV Expat has not only aimed to assist its expatriate clients search for “custom insurance” but also defend their rights in the event of a claim.

Ask for your free online quote: automobile, health, home, business, travel, or other insurance. Contact us by email at [email protected] or by phone +351308809541 or WhatsApp (+351) 910 80 8

![]()