Life insurance quote in Portugal

Life insurance in Portugal holds no secrets for Inov Expat, which will be able to guide you to finding the best life insurance for you and your family.

Complete the following form to receive a comparison of the best policies on the market, adapted to your needs :

More information about life insurance in Portugal

In order to be able to choose the right life insurance in Portugal for your needs, you first need to know how it works. Life insurance is personal insurance that covers the risks connected with the insured party’s disability or death. The main purpose of this type of insurance is for the insured party to guarantee their own financial security in the event of a disability and the financial security of their dependents in the event of the insured party’s death.

With this type of insurance, there are 3 possible intervening parties:

The policyholder: the person who signs and pays for the insurance policy

The insured party: The disability and/or death of the insured party are covered and determine the value of the insured capital

The beneficiary: the person who receives an indemnity in the event of the death of the insured party

Even though there are many, we offer explanations below of the two main types of existing life insurance policies:

- Temporary life insurance: a periodic premium is paid for a guaranteed capital in the event of death or disability. The policy is renewed annually and the premium increases every five years based on the insured party’s age.

- Payment protection (or fixed premium) life insurance: a constant premium is paid for a defined term. This type of insurance is mostly used with real estate mortgages.

When is it a good idea to take out a life insurance policy?

- You are the head of household and wish to guarantee your children’s future in the event of your death.

- If you exercise a risky profession, you constantly drive or do any extreme sports.

- You have purchased real estate through a bank loan and wish to guarantee repayment of the loan in the event of an accident or illness.

- You are young and wish to protect yourself against a disability or illness that may affect your professional career.

- You are a key person in your company and wish to guarantee its continuity in the event of your death or disability.

- You are a partner in a company and wish to guarantee other partners the possibility of purchasing your stakes in the event of your death.

These are just a few examples to illustrate the many possibilities of this type of insurance which is the only kind that covers you and your family or those that depend on you.

Don’t think twice about contacting us so we can find the most appropriate life insurance solution for your situation together.

If you’d like to know more about life insurance, we invite you read our article “insuring life" where many of the questions you still may have regarding this very important type of insurance are answered.

Inov Expat

We are an insurance broker that has been working with the best insurance companies in the market since our foundation in 2004 to be able to offer you a life insurance solution that is particularly well adapted to your needs and at the best price. We can answer all your questions as well as handle any claims necessary throughout the term of your life insurance policy and act as privileged liaisons to defend your rights against insurance companies. Our service is free.

Search

Articles

Community insurance in Portugal: Understand everything in 6 questions

Index

ToggleCommunity insurance in Portugal: Understand everything in 6 questions

A condominium is exposed every day to multiple risks that require urgent and necessary services to deal with them. It is therefore important to subscribe community insurance in Portugal, here called "seguro de condominio", for the peace of mind of all neighbours. If you want to know more, read our article!

What does the condominium insurance cover?

Condominium insurance is insurance that protects the common areas of a building. It is used to cover damage to the building and the civil liability of the condominium.

Is this insurance compulsory in Portugal?

It is compulsory to have fire insurance, both for the independent parts and for the common parts of the co-ownership.

Does the Community insurance cover my flat?

No, the "seguro de condominio" insurance does not cover damage to your flat. For this, you will need to take out a home insurance policy. Don't hesitate to request a home insurance quote by clicking here.

The condominium insurance will cover damage to the common areas. Your home insurance will cover damage to your own appartment.

Is water damage covered by this insurance?

Most Portuguese insurance companies include water damage caused by collective pipes in their basic cover.

What are the main coverages of this insurance?

The main guarantees are as follows:

- Civil liability: for damage that may be caused to third parties (e.g. slippery stairs, fall of a part of the roof that causes damage to a third party, etc.).

- Material damage : such as fire, explosion, lightning, atmospheric or seismic phenomena.

- Water damage

- Assistance for condominiums: most insurance companies include a 24-hour assistance service, 365 days a year

- Unclogging of communal pipes

- Glass breakage in common areas

- Defence/legal assistance

Who should take out condominium insurance?

All co-owners must take out co-ownership insurance ("Condominio" insurance).

How much does the “seguro de condominio” cost?

The insurance premium varies depending on the optional cover included but it can vary between 50 and 100 euros per year and per accommodation.

You can request your community insurance quote by clicking here.

Femme vecteur créé par pch.vector - fr.freepik.com

INOV Expat - Who are we?

INOV Expat is an insurance brokerage firm aimed at French and English-speaking expatriates in Portugal and Spain, which has signed partnership agreements with the leading insurance companies on the market. We are based at Lisboa, Barcelona and Madrid. We know just how much moving to another country can bring about a lot of surprises and procedures which are sometimes quite complex.

So, ever since its foundation in 2004, INOV Expat has not only aimed to assist its expatriate clients search for “custom insurance” but also defend their rights in the event of a claim.

Ask for your free online quote: automobile, health, home, business, travel, or other insurance. Contact us by email at [email protected] or by phone +351308809541 or WhatsApp (+351) 910 80 8.

![]()

Car insurance: Take out your car insurance in Portugal

Index

ToggleCar insurance: Take out your car insurance in Portugal

Is car insurance compulsory in Portugal?

In Portugal, the only compulsory insurance that exists is third party liability insurance, which is compulsory for any vehicle registered. Car insurance is compulsory in Portugal.

Why take out car insurance?

Taking out civil liability insurance will enable your insurance company to cover the expenses that may result from an accident in which your vehicle is involved and for which you are responsible. It will not only be used to repair the person's car, but will also provide the corresponding compensation.

What types of insurance are available in Portugal?

There are 3 options that you can take out to insure your vehicle in Portugal:

- Third party: will cover your civil liability in the event of an at-fault accident.

- Third party theft and fire: will cover your civil liability in the event of an at-fault claim, but also for damage linked to fire and theft.

- Fully comprehensive with/without deductible or excess: in addition to your liability insurance, the insurance will also cover any damage your vehicle may have suffered.

I have a no claim discount in UK : will it be applied in Portugal?

Not all companies will apply your no claim discount.

As insurance broker specialising in insurance for expatriates living in Portugal, we have specific agreements with the insurance companies and we will be able to apply your no claim discount without any problem.

To receive a car insurance quote, you can ask for a quote by clicking here.

Can I insure my vehicle with a UK registration in Portugal?

No, it won’t be possible to insure a vehicle with UK registration in Portugal.

If you do not have Car insurance, do not hesitate to ask us for a comparison of the best insurance here

If you have any questions, please do not hesitate to contact us directly by phone on +351 910 808 061 or through WhatsApp on (+351) 910 80 80 61. or by email: [email protected]

Got the Delorean from “Back to the Future” and don’t know where to insure it?

Vector de Ribbon creado por freepik - www.freepik.es

INOV Expat - About us

INOV Expat is an insurance brokerage firm aimed at French and English-speaking expatriates in Portugal and Spain, which has signed partnership agreements with the leading insurance companies on the market. We know just how much moving to another country can bring about a lot of surprises and procedures which are sometimes quite complex.

So, ever since its foundation in 2004, INOV Expat has not only aimed to assist its expatriate clients search for “custom insurance” but also defend their rights in the event of a claim.

Ask for your free online quote: automobile, health, home, business, travel, or other insurance. Contact us by email at [email protected] or by phone +351308809541 or WhatsApp (+351) 910 80 80 61

Life insurance: Is it good to subscribe your insurance with the bank?

Index

ToggleLife insurance: Is it good to subscribe your insurance policy with the bank?

Subscribing a life insurance through the bank is not mandatory in Portugal. Since the law nº222/2009, the banks have to say in their mortgage quotes that the client can subscribe a life insurance with another company, as long as the policy matches the requirements of the bank.

Life insurance: Is it good to subscribe your insurance policy with the bank?

Life insurance has different goals:

- Protect your family: in case of death of the insured, the amount insured will be paid to the beneficiaries of the policy. If there is no beneficiary mentioned on the policy, will be considered the legal heirs (remaining spouse, children…).

- Guarantee the payment of a loan for banks: in case of death of borrower’s death, the amount insured will be paid to cover the refund of the mortgage.

Is it mandatory to subscribe a life insurance with the mortgage?

Life insurance is NOT mandatory to obtain a mortgage in Portugal. However, in most cases it will be required by the banks. According to the new law of mortgages, the banks can no longer force their customers to subscribe other things related to the mortgage like a home, life or car insurance and have to inform their customers that they can transfer their life insurance linked to the mortgage during the contract.

Life insurance without the bank

Following the application of Legislative Decree nº222/2009, the government wanted to reinforce the protection of the customers.

- The banks can no longer penalize you by giving you worse conditions for your mortgage simply because you decided to subscribe a life insurance with another company.

- They can still require you to subscribe a life insurance but not impose their contract.

You have to know that usually life insurance the banks offer is more expensive than those from an insurance company or broker. The banks will offer a discount of the interest rate if you subscribe to some of their products, like insurance policies. Knowing that, we recommend you always read carefully the details of your mortgage project to know if it is worth it to subscribe your insurance with your bank or not.

Here is an example: David has signed with his bank a life insurance policy for 500€ per year. If he decides to cancel it and subscribe with another company, he will have a penalty that will raise his refund of the mortgage from 601€ to 607€ per month. After doing some research, he found out that he can have the same life insurance policy for 100€ per year with another company. If he moves forward, the mortgage will cost him 72€ more per year (6€ more per year), but the life insurance will cost him 400€ less per year. Changing his life insurance will then allow him to save up to 328€ per year.

In resume, you have to keep in mind that going with another insurance company can mean you are saving a significant amount of money per year, but also and more importantly on the long run. Imagine saving 300€ per year for 20 year, at the end of the day you will have saved thousands.

Why is the insurance so expensive with the banks?

For the banks, life insurance, home insurance or pension plans allows them to compensate in a big way the low interest rate of the mortgage.

What if I already have an insurance with the bank?

If you already have an insurance policy with the bank that gave you the mortgage, keep in mind that you can always choose to cancel it and choose to subscribe to another one with another insurance company by following some very simple rules:

1.-Check the renewal date of your insurance policy.

Engage the procedure of cancellation as soon as possible and inform your bank that you wish to cancel your policy by telling them at least 1 month prior to the renewal. It is important that you do it, or else when the policy comes to renewal, it will be renewed automatically.

2.- Choose the best insurance by going through a broker.

An insurance broker is a specialist who will advise you and offer you the best covers after studying your profile carefully.

3.- Once the new life insurance is subscribed, transfer the conditions to your bank so they can validate them and maintain your mortgage active.

If you don’t have life insurance yet, don’t hesitate to ask us for a comparison of the best life insurance here.

More information about life insurance

If you want to know more about life insurace we recommend you to read our article:

Life Insurance in Spain: How does it works?

INOV Expat - Who are we?

INOV Expat is an insurance brokerage firm aimed at French and English-speaking expatriates in Portugal and Spain, which has signed partnership agreements with the leading insurance companies on the market. We know just how much moving to another country can bring about a lot of surprises and procedures which are sometimes quite complex.

So, ever since its foundation in 2004, INOV Expat has not only aimed to assist its expatriate clients search for “custom insurance” but also defend their rights in the event of a claim.

Ask for your free online quote: automobile, health, home, business, travel, or other insurance. Contact us by email at [email protected] or by phone +351308809541 or WhatsApp (+351) 910 80 8

![]()

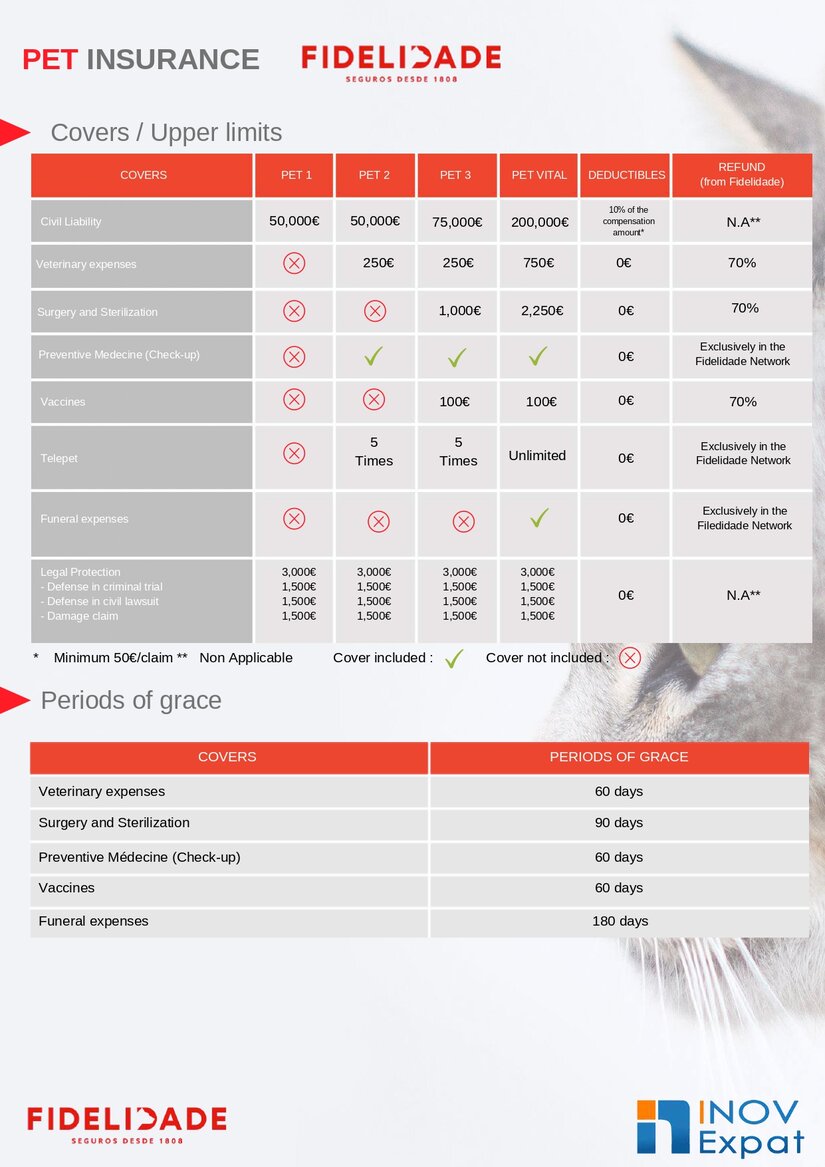

Pet Insurance : how does Pet Insurance work in Portugal ?

Index

TogglePet Insurance : how does Pet Insurance work in Portugal ?

1. Covering civil liability for your pet in the event of material damages or bodily harm caused to a third party

In Portugal, your home insurance (not mandatory if you’re a tenant) covers the civil liability of all the occupants of the home including your 4-legged companions, whether cats or dogs.

Pet Insurance : how does Pet Insurance work in Portugal ?

However, since 2003, Portuguese law has made the conditions for owning certain dogs considered potentially dangerous harsher:

- Brazilian mastiff

- Argentine dogo

- Pit bull terrier

- Rottweiler

- American Staffordshire terrier

- Staffordshire bull terrier

- Tosa Inu

In addition to having to declare these animals with the Portuguese authorities and holding a licence, owners of dogs identified as “dangerous” must take out special civil liability insurance for their dog: the civil liability cover that comes with your home insurance does not cover any damage caused by such a pet!

For the races non stated above, a pet insurance will in any case cover for a higher amount (between 50.000 and 200.000€) than your home insurance.

2. Vet assistance

Subscribing for pet insurance allows you to reduce your veterinary expenses. These contracts always include hospitalization, veterinary consultations and medical check-ups.

You can also add if you want a cover for the vaccines you need to renovate.

Other covers are also included, such as video consultations or funeral expenses (optional) in case of death of your pet.

INOV EXPAT, insurance broker and specialized in expatriates since 14 years recommends the insurance policy of Fidelidade, leader of the market in Portugal. Unlike the insurance contracts other Portuguese companies offer, this one gives you the option of choosing which clinic you want to go to. If you already know a vet you trust, you can keep going to the same one, reducing the cost of your expenses.

For less than 15-20€/month (cost can change depending on : race, gender and age of the pet) you can protect your dog/cat the best possible way.

INOV Expat - About us

INOV Expat is an insurance brokerage firm aimed at French and English-speaking expatriates in Portugal and Spain, which has signed partnership agreements with the leading insurance companies on the market. We know just how much moving to another country can bring about a lot of surprises and procedures which are sometimes quite complex.

So, ever since its foundation in 2004, INOV Expat has not only aimed to assist its expatriate clients search for “custom insurance” but also defend their rights in the event of a claim.

Ask for your free online quote: automobile, health, home, business, travel, or other insurance. Contact us by email at [email protected] or by phone +351308809541 or WhatsApp (+351) 910 80 80 61

![]()

Coronavirus COVID-19 : how your insurance is going to help you ?

Index

ToggleCoronavirus COVID-19 : how your insurance is going to help you ?

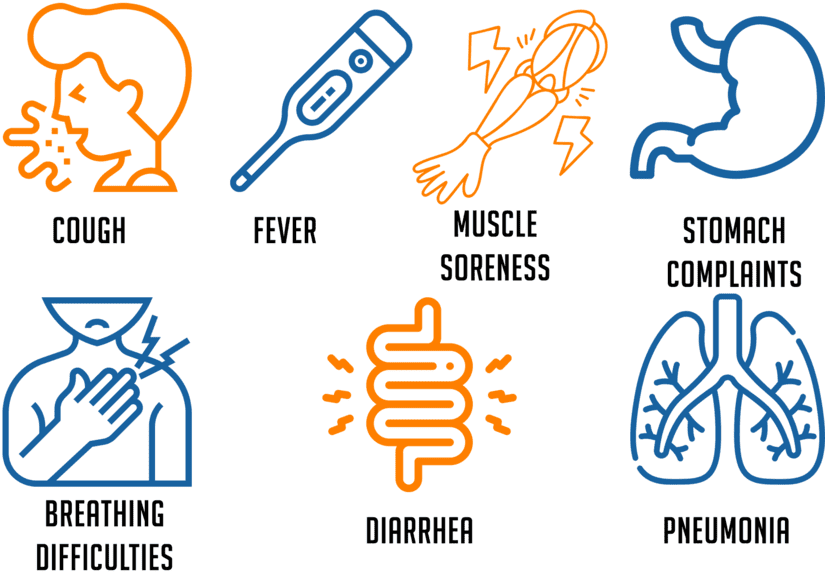

The Covid-19 coronavirus, originally known as the Chinese coronavirus or Wuhan pneumonia - the city where the epidemic originated - is keeping the world on alert and has caused an unprecedented health crisis, aggravated by its spread outside China all over the world, including Portugal. In this article, we will give you the best advices and above all, how your health insurance can help you.

Coronavirus COVID-19 : how your insurance is going to help you ?

What does mean « Coronavirus » ?

Coronaviruses are a family of viruses discovered in the 1960s but of unknown origin. Coronavirus disease is an infectious disease. At this time, there are no vaccines or treatments.

How to avoid the spread of the virus?

The first important step you should take is to avoid contact with anyone who has been affected or has had contact with an affected person. This also applies to those who have many of the symptoms of the coronavirus. Please see below a list of the symptoms:

-

Avoid risky contacts

-

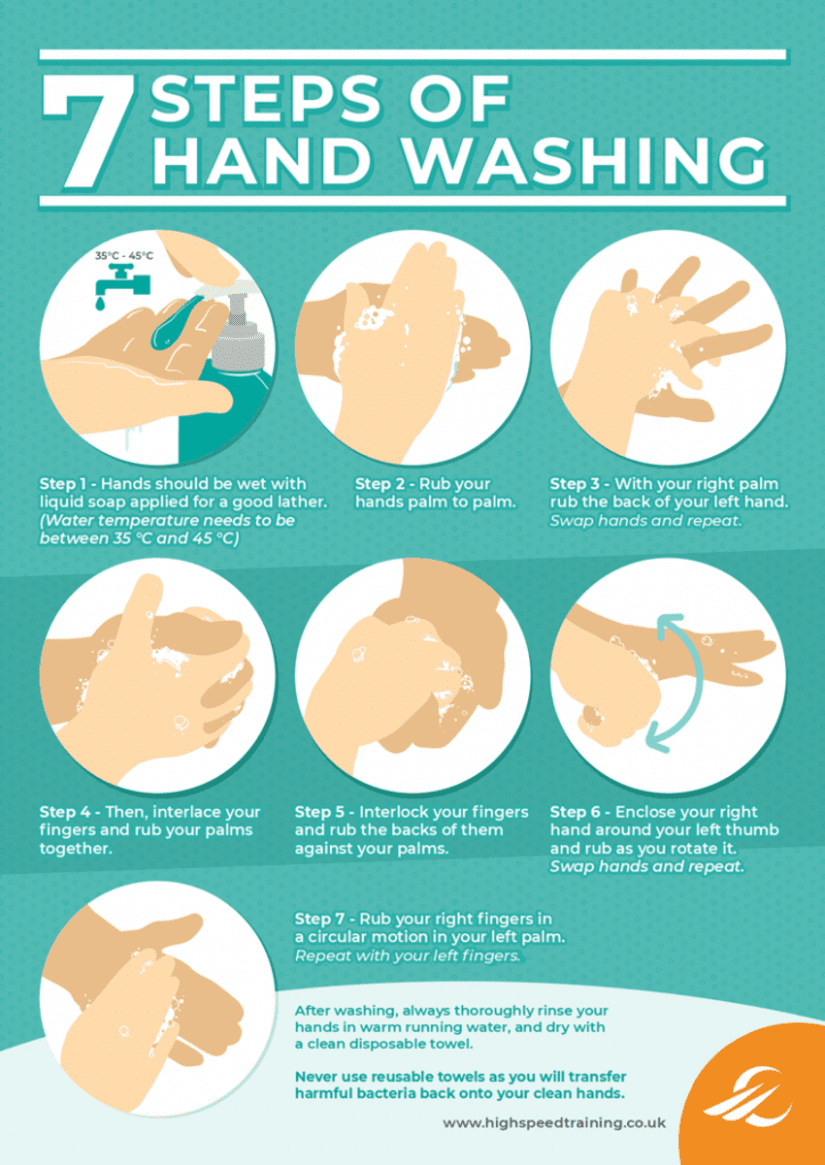

Hygiene measures

It is extremely important to have an impeccable lifestyle and wash your hands frequently (Hot water, 20 seconds, all surfaces of the hands, between the fingers but also at the wrists).

-

Safety distances:

Avoid built-up areas and try to keep at least 1 meter away from other people, especially if they have been exposed.

-

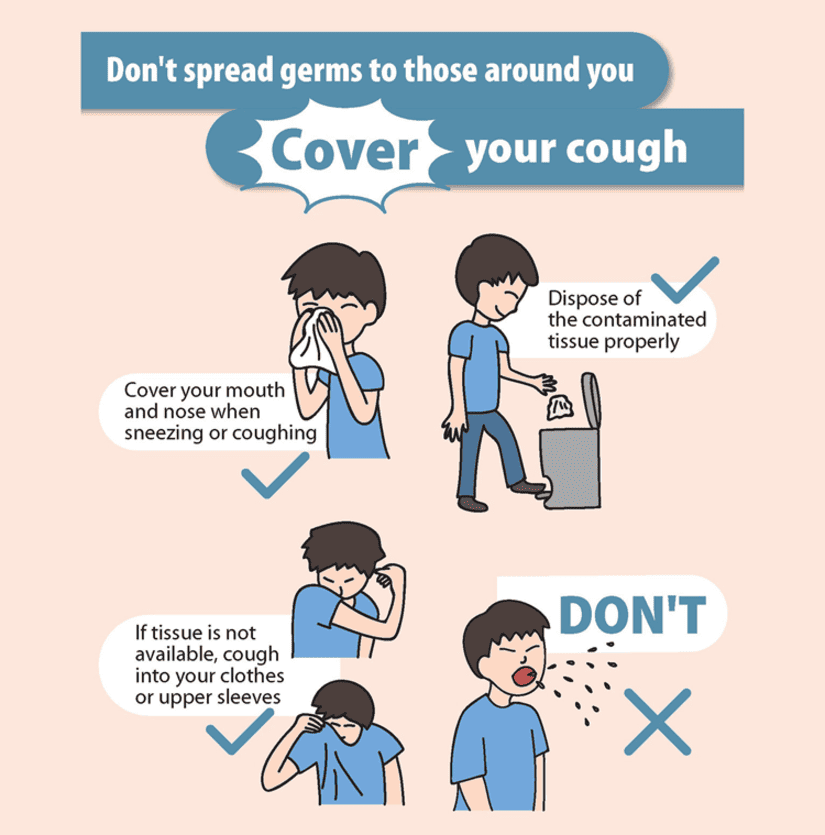

Cough/sneeze carefully

-

Cooking process

Cook food sufficiently, especially meat and eggs.

How can your health insurance help you?

Dedicated phones

If you have any doubts about a possible contamination, see below the specific pone numbers you can use to inform you:

Fidelidade Multicare (from Portugal) : +351 808 782 424

Fidelidade Multicare (abroad) : +351 217 948 704

Una Seguros (from Portugal) : +351 707 100 131

Una Seguros (abroad) : +351 210 184 442

Medis : +351 218 458 888

This service will allow you to request additional information on symptoms and what to do in case of possible contamination.

If you have symptoms of the virus do not go directly to a medical centre, thanks to your health insurance you can request a home visit.

-

Screening Tool

Medis, Fidelidade Mutlicare and Una Seguros are committed to covering the screening tool for people who have a health insurance contract that includes Ambulatory Plan coverage, always under medical prescription.. There is no cost to the client.

-

Video consultations

Thanks to your health insurance with Fidelidade Multicare, you will get for free the application MULTICARE MEDICINA ONLINE which allows you to carry out a video consultation with a specialist doctor. You will be able to see and talk to a doctor, can update and share photos or tests for evaluation. You will need to download the application, register and you will then be able to get an appointment during the day.

Download the App here : (links for IOS and Android)

IOS:

Android :

For customers who have the ''Medicina online'' guarantee subscribed to in their health insurance policy they can carry out an online test. Link : https://www.medicinaonline.pt/pt/avaliador-de-sintomas/

If you don't have health insurance yet, don't hesitate to ask us for a comparison of the best health insurance here.

For all Inov Expat clients if you have any questions, do not hesitate to contact us directly by phone at +351308809541

INOV Expat - Who are we?

INOV Expat is an insurance brokerage firm aimed at French and English-speaking expatriates in Portugal and Spain, which has signed partnership agreements with the leading insurance companies on the market. We know just how much moving to another country can bring about a lot of surprises and procedures which are sometimes quite complex.

So, ever since its foundation in 2004, INOV Expat has not only aimed to assist its expatriate clients search for “custom insurance” but also defend their rights in the event of a claim.

Ask for your free online quote: automobile, health, home, business, travel, or other insurance. Contact us by email at [email protected] or by phone +351308809541 or WhatsApp (+351) 910 80 8

![]()

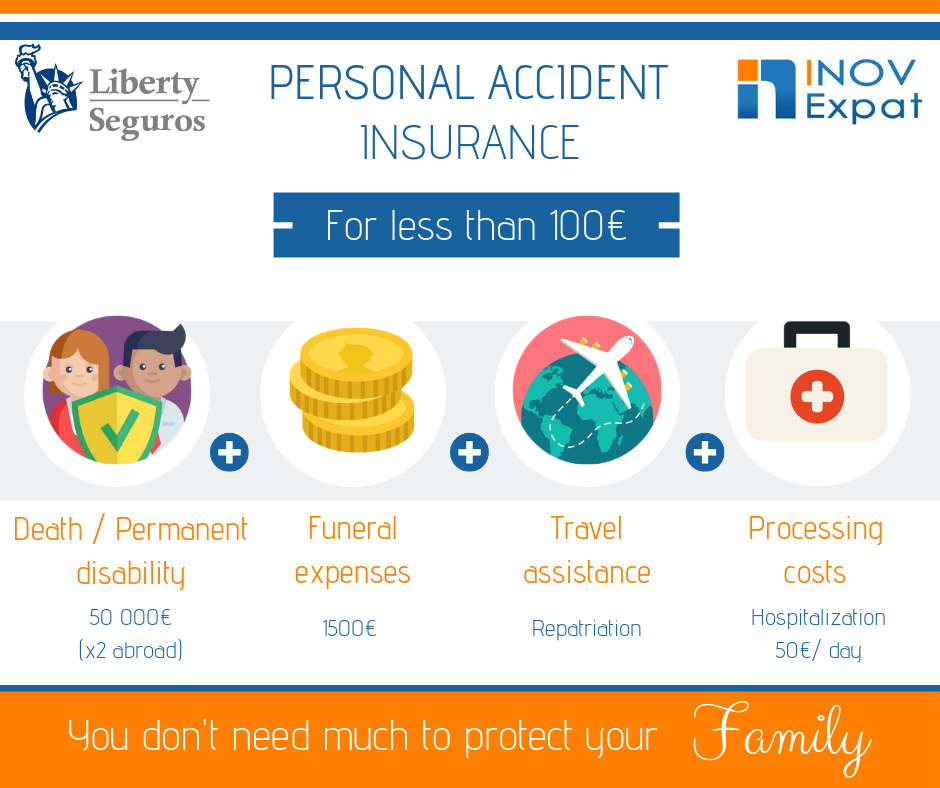

Personal Accident Insurance : Guide in Portugal

Index

TogglePersonal Accident Insurance : Guide in Portugal

1- Why should I take a Personal Accident Insurance in Portugal ?

a) What is a Personal Accident Insurance ?

The personal accident insurance is a personal insurance method which covers risks as disability, death, processing costs of the insured and gives you access to a medical assistance intended to cover hospital fees in Portugal, in case of an accident.

b) Who is covered by my Personal Accident Insurance ?

Suscribe a Personal Accident’s Insurance might be a real advantage for your tranquility, the one of your family and your financial security.

Besides ensuring economic security to the insured at a fair price, the Personal Accident’s Insurance allows to cover the entire group of people that directly depends of the insured if this one comes to die.

c) How can I calculate my Personal Accident’s bonus?

Considering that the risk of an accident is the same for everyone, the bonus will be identical whatever your age. So, the bonus is fix!

2- How work my Personal Accident Insurance?

a) In case of death of permanent disability

In case of death, the sum insured will be reversed to beneficiaries figuring on the contract. If there are no beneficiaries mentioned, the sum will be reversed to legal successors.

In case of permanent disability, will be reversed the % of the sum insured taking into account the devaluation table.

b) In case of temporary disability and hospital admission ?

The insurer pays the daily allowance set during the hospital stay or the clinic stay, for a time never above 360 days.

3- Processing costs

a) What are processing costs?

Processing costs are medical and hospital fees, including medecine costs and infirmary fees.

b) What should I do in case of a regular clinic treatment?

In case of a regular clinic treatment, are included delocalization fees of the insured to the doctor, the hospital, the clinic or the infirmary care station, as long as the mean of transport used is the adequate one.

c) How to get reimbursed for your processing costs?

The reimbursement of costs is done upon presentation of valid documentary.

d) Reimbursement of funeral expenses

Reimbursement until the quantity set in funeral expenses’s particular conditions of the insured.

4- Medical assistance in Portugal and medical assistance Abroad.

a) Medical assistance in Portugal

Below are different points that supports the medical assistance in Portugal:

- Hospital Admission

- Ambulatory Assistance

- Search and send of medecines

b) Medical assistance Abroad

Below are different points that supports the medical assistance Abroad:

- Medical transportation of repatriation of the injured and/or sick

- Accompaniment during medical transportation of repatriation

- Accompaniment of the hospitalized insured

- Round-trip ticket for an insured relative

- Extension of the stay at the hostel

- Medical, surgical, pharmaceutical and hospitalization fees abroad

- Repatriation or transportation of the deceased person and companions

- Luggage theft abroad

- Cash advance

- Trip cancellation

- Delay for luggage reclaim

- Flight delay

- Loss of airline connection

- Loss of flight for public transports reasons

- Legal Assistance abroad

c) Theft, loss or deterioration of luggages during the travel

In this case, the insurance includes the payment of damages caused to the luggage for theft, loss or deterioration.

However, the insurance does not refund:

- Cash, cheques, credit cards, all kind of documents, travel tickets

- Jewellery, watches and other objects made of metals and precious stones

- Art pieces and collections

- Fur coat

- Cellphones, laptops and their respective accessories

- Photo camera and camera

- Fragile goods

- Prosthetics or Orthotics

d) What is my capital insured in case of theft, loss or deterioration ?

The capital is 1.250€ with a sub-limit of 250€ per loss or damages items.

The word of INOV : “I always advice my clients to subscribe a Personal Accident Insurance. It is not mandatory but can be very useful if you face the unexpected. It can facilitate the life of the insured as the one of his family in case of accident.” - Benjamin Retali

INOV Expat - Who are we?

INOV Expat is an insurance brokerage firm aimed at French and English-speaking expatriates in Portugal and Spain, which has signed partnership agreements with the leading insurance companies on the market. We know just how much moving to another country can bring about a lot of surprises and procedures which are sometimes quite complex.

So, ever since its foundation in 2004, INOV Expat has not only aimed to assist its expatriate clients search for “custom insurance” but also defend their rights in the event of a claim.

Ask for your free online quote: automobile, health, home, business, travel, or other insurance. Contact us by email at [email protected] or by phone +351308809541 or WhatsApp (+351) 910 80 8

![]()

Life Insurance in Portugal : everything you need to know

Index

ToggleLife Insurance in Portugal : everything you need to know

Planning to better guarantee the future of your loved ones means protecting yourself against a disability, for example, that may affect your daily life as well as your loved ones. It also means ensuring the mortgage on your home is paid in the event of death or disability. Life insurance is for those things! But, that’s not all...

What is life insurance exactly?

Life insurance is a contract which, after payment of a premium, insures subscribers (or anyone who depends on him/her) against all risks related to disability or death.

There are different types of life insurance contracts on the market, but here are some of the main ones:

- Annual renewable term life insurance:

This type of contract is renewed annually and provides for a guaranteed benefit in the event of the insured person’s death or disability. The premium is recalculated and increases each year upon renewal based on the insured person’s age.

- Decreasing term (or level premium) life insurance:

This is the type of contract used with property mortgages like real estate loans, for example. With this type of contract, the premium is at a fixed rate for a limited period of time. This type of insurance is largely used in cases where you wish to guarantee the payment of a mortgage.

How does Portugal tax life insurance?

As of 1 January 2004, Portugal officially ended inheritance tax and taxes on gift donations. Only stamp duty must be paid on property in Portugal: 10% + 0.8% for fixed property transfers.

However, life insurance premiums and commissions paid as part of life insurance contracts are not subject to stamp duty in Portugal. In any case, note that any premiums paid under the contract are subject to taxes: 0.048% to the Insurance Surveillance Authority and 2.5% to the National Medical Emergency Service (“INEM”).

In the event of a buyback, only the portion of the products (interest, capital gains...) included in the buyback are taxed at a 28% flat rate in Portugal. This rate can be reduced to 22.4% under certain conditions, particularly if the contract was signed more than 5 years before, or to 11.2% if the contract was signed more than 8 years before.

Why is life insurance so important?

Life insurance is probably the planning tool that should be prioritised by everyone whether a head of household or entrepreneur. In the event of a disability or death, life insurance can guarantee your children’s education, ensure a certain living standard is maintained by your loved ones and, if you are in a key position at your company, provide for the continuation of your business project.

To find out more about life insurance and get a quote, contact INOV Expat right away. We’ll answer all your questions for free and suggest some solutions that are adapted to your needs as quickly as possible.

INOV Expat - Who are we?

INOV Expat is an insurance brokerage firm aimed at French and English-speaking expatriates in Portugal and Spain, which has signed partnership agreements with the leading insurance companies on the market. We know just how much moving to another country can bring about a lot of surprises and procedures which are sometimes quite complex.

So, ever since its foundation in 2004, INOV Expat has not only aimed to assist its expatriate clients search for “custom insurance” but also defend their rights in the event of a claim.

Ask for your free online quote: automobile, health, home, business, travel, or other insurance. Contact us by email at [email protected] or by phone +351308809541 or WhatsApp (+351) 910 80 8

![]()

Executive Insurance

Index

ToggleExecutive Insurance

Are you a company executive? Have you heard of “D&O” insurance?

It’s actually “Directors and Officers” insurance which covers company directors’ and officers’ liability, particularly in the event of a management failure.

Here are a few explanations with regard to this insurance...

Why take out directors and officers liability insurance?

“Each time you see a successful company, you tell yourself it’s because someone once made a courageous decision,” says Peter Drucker, an American management professor.

Taking risks and making courageous decisions are daily tasks in the world of business, but it also sometimes leads miscalculations and management errors. Whether they come from a director or an employee, these management errors can have potentially disastrous consequences on the company’s future and involve liability issues.

That is why protection against “everyday” management mistakes is one major part of D&O insurance.

Insurance for executives: what does it cover?

Everyday management mistakes are covered by Directors and Officers insurance such as errors on tax statements, forgotten payments and even poor investment choices, for example.

It also covers errors or omissions that may unknowingly lead the company to a violation of its legal obligations.

This insurance can also cover “director-employee issues”: a failure to make good on a promise for promotion, for example.

This guarantee enables access to legal experts who can advise you on how to resolve your disputes.

Who is “directors and officers liability” insurance for?

This “executive” insurance does not company companies as legal entities, but rather the decision makers themselves to the extent of their duties. It may be signed by the company to cover its directors and officers.

> For more information on our “directors and officers liability” insurance offers, contact our advisors right away by email and they’ll answer you for free: [email protected].

INOV Expat - Who are we?

INOV Expat is an insurance brokerage firm aimed at French and English-speaking expatriates in Portugal and Spain, which has signed partnership agreements with the leading insurance companies on the market. We know just how much moving to another country can bring about a lot of surprises and procedures which are sometimes quite complex.

So, ever since its foundation in 2004, INOV Expat has not only aimed to assist its expatriate clients search for “custom insurance” but also defend their rights in the event of a claim.

Ask for your free online quote: automobile, health, home, business, travel, or other insurance. Contact us by email at [email protected] or by phone +351308809541 or WhatsApp (+351) 910 80 8

![]()

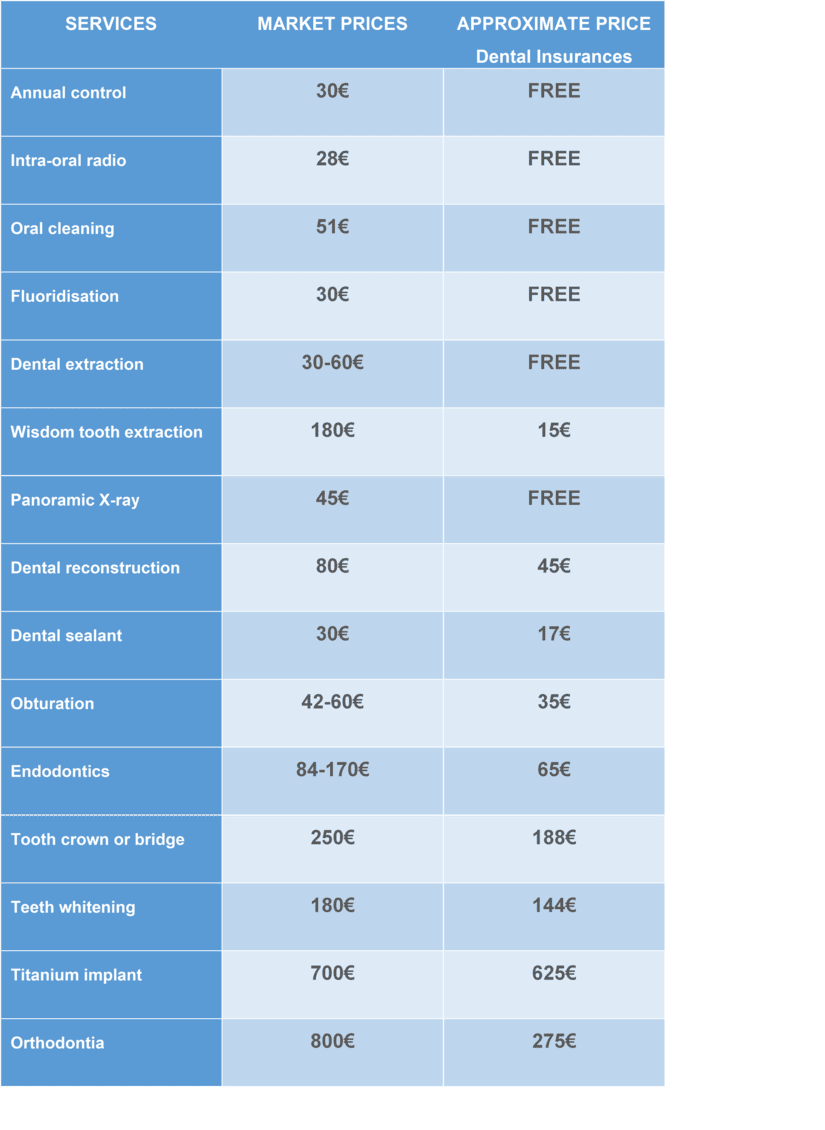

How does Dental Insurance work in Portugal ?

Index

ToggleHow does Dental Insurance work in Portugal ?

Keep smiling with dental insurance!

Everyone knows nowadays that paying attention to oral hygiene is not a matter of how you look, but rather a way to maintain overall health. Yet, the truth is, even if you see it as a health issue, dental care can sometimes be quite costly.

That is why dental insurance may seem like THE solution for no longer putting off important dental work because of the cost.

In all reality, “traditional” health insurance covers basic dental care. But as soon as you need more complicated treatment for your teeth or your gums (crowns, bridges, implants, etc.) only supplementary dental insurance will bring you peace of mind: it actually covers more complex care and sometimes enables access to free dental services or preferential rates.

The treatments covered by supplementary dental insurance are generally as follows:

- Dentist, periodontologist and orthodontist visits

- Dental care (scaling, cavities, tooth extraction...)

- Periodontal treatments

- Orthodontics

- Dental prostheses (implants, bridges, crowns...)

Summary table of free or highly reduced treatments with dental insurance

Dental insurance: how to use it

We recommend reading and comparing before signing any supplementary dental insurance policy!

In fact, it’s important to understand the scope of the “free” services and those at “preferential” rates included in your policy to ensure they match your “patient profile”.To benefit from the preferential or free rates, the insurance company will impose certain providers. So, if you wish to see a dentist near your home, it’s important to ensure that provider is covered by the insurance company.

The cost of this type of dental insurance policy is around €7-15 per month per person with families receiving special rates.

INOV Expat - Who are we?

INOV Expat is an insurance brokerage firm aimed at French and English-speaking expatriates in Portugal and Spain, which has signed partnership agreements with the leading insurance companies on the market. We know just how much moving to another country can bring about a lot of surprises and procedures which are sometimes quite complex.

So, ever since its foundation in 2004, INOV Expat has not only aimed to assist its expatriate clients search for “custom insurance” but also defend their rights in the event of a claim.

Ask for your free online quote: automobile, health, home, business, travel, or other insurance. Contact us by email at [email protected] or by phone +351308809541 or WhatsApp (+351) 910 80 8

![]()

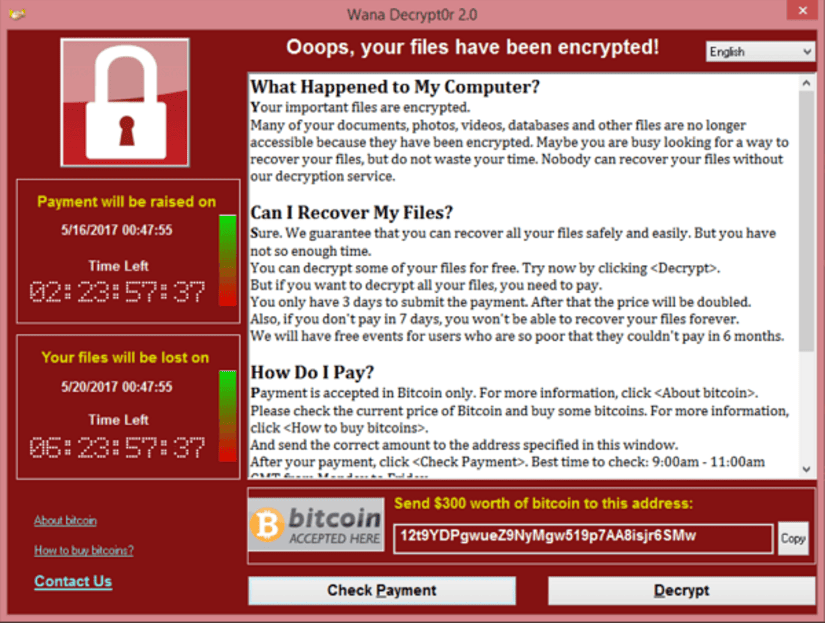

Cyber Insurance

Index

ToggleCyber Insurance

Unless you’re a “geek” and passionate about all things digital, Wannacry and Notpetya are probably names that mean nothing to you. However, they really shook up the information security managers at the largest companies in the world in 2017.

They are the names of two new digital viruses (malware) which blocked several companies and “held them to ransom” and even made it impossible for them at times to access all their digital data. They were believed to be something only seen in action films or companies with strategic businesses. Yet the truth is these new pirates are actually targeting all computers and servers, whether isolated or networked, connected to the Internet or not, including peripheral devices such as printers, mobile phones, tablets and even online gaming consoles.

This means surveillance is a concern for all digital users whether a company or “simply” a private citizen like you and me!

What exactly is a cyberattack?

Your computer is first “harpooned” by a rather commonplace email from Google, for example (but also from your telephone operator or a power utility company, etc.) automatically asking you to go online to complete or modify your details: that’s the “phishing” or harpooning phase that allows pirates to enter your computer. It’s actually like just giving out your flat keys to thieves who will then “shop” through your valuables or even block access to your home. In the case at hand, it’s about accessing your computer data.

In general, hackers then insert malware, malicious software, to encrypt the data on your computer or completely block access to a company’s computer server: it is then impossible to regain access and the data without a paying for a code (ransomware) as demanded by the pirates in cryptocurrency (bitcoins, for example). The data companies store in the Cloud (external memory servers) are particularly targeted by pirates who have, in fact, been able to “harpoon” the details and even the bank details of 57 million Uber customers in this way!

This is what a hacking message with the Wannacry virus looks like:

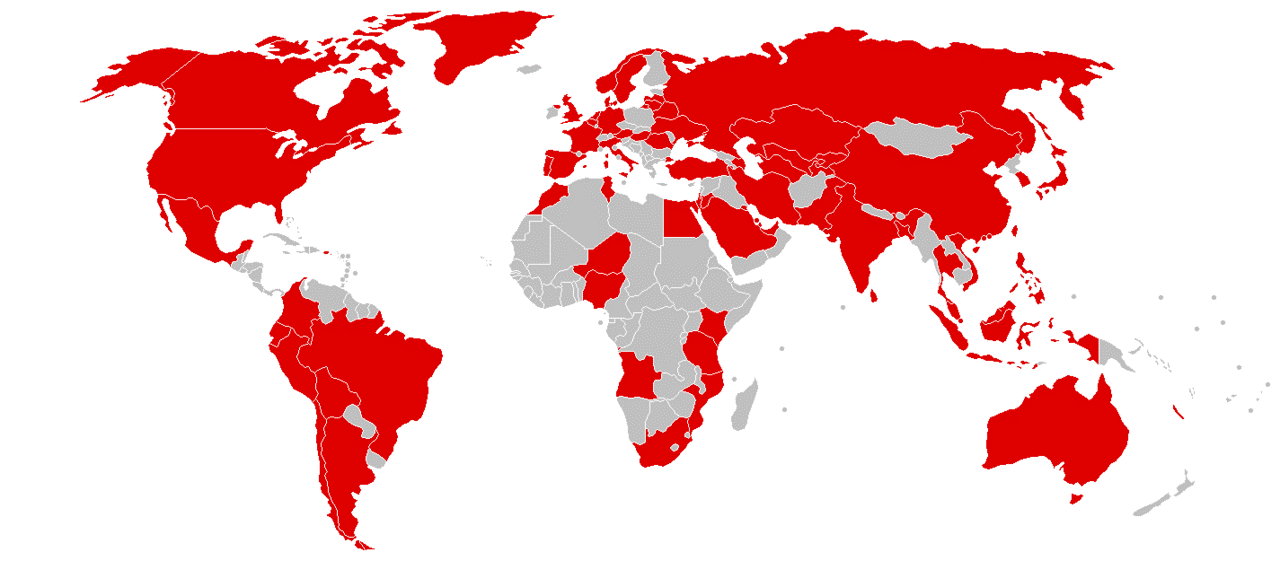

Cyberattacks against companies?

Irrespective of their size, companies are hackers’ prey of choice, especially when they have got confidential data that can “make money” through ransom! 2017 was a bad year for companies, particularly French ones, as far as cyberattacks: St Gobain, Renault and even SNCF were some of the many victims of digital piracy attacks. However, everyone on the planet needs to be concerned as no sector is safe.

Once infiltrated into a computer network, malware or “spyware” communicates with the pirates to inform them of antivirus and other firewall failures to domesticate the “hacked” network and insert ransomware even easier at a future time.

The pirates’ goals when attacking a company:

- Crimes for financial gain: collecting customers’ personal data, particularly their bank details, to exploit or resell them.

- Spying: collecting sensitive and confidential information and then make money from it through competing companies or governments.

- Destabilisation: Harming a company’s image by publishing sensitive information related to failures to observe hygiene and safety regulations, for example.

- Sabotage: Intentionally deteriorating a company’s computing system and harming their economic activities.

According to a study by The ThreatMetrix, Q1 2018 Cybercrime Report, the volume of cyberattacks hitting Europe in the first quarter of 2018 was 30% higher than during the same period the previous year. Insurance solutions against cyberattacks (such as the type offered by Axa) are now available on the market.

Map of countries affected by cyberattacks

Do cyberattacks really target private citizens?

Contrary to popular belief, “private citizens” can also be targeted by Internet pirates: in fact, amateur hackers generally train with these kinds of targets which are easier to access and have got less powerful security systems than companies. Less vigilant, less aware and, therefore, less protected, private citizens who are nowadays multi-connected to the Net via different devices are easy prey for these “budding” hackers.

How can you prevent a cyberattack?

- Do not trust any seemingly trivial email requesting your details or asking you to enter your bank card number. What’s more, emails with minor syntax or spelling errors should also have you on alert: never open them or click on any link in them as you will be opening a direct door to malware.

- Regularly save your data on external hard drives for peace mind as far as your important files in the event of a malicious virus.

- Install a good antivirus program (the best ones on the market must be paid) and update it regularly as it will be able to find malicious programs like Trojan horses.

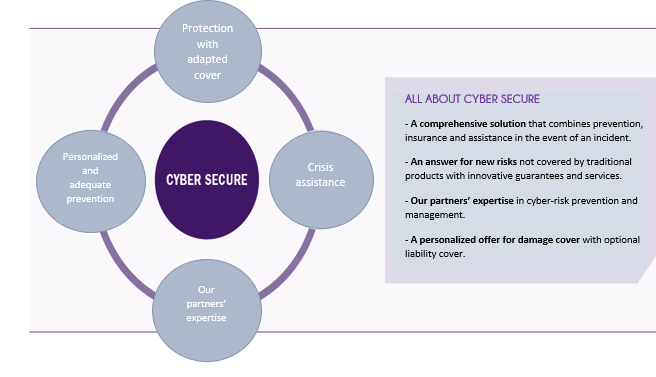

Why take out cyber insurance?

Insurance solutions against cyberattacks (such as the type offered by Axa below) are now available on the market.

Cyber insurance covers financial losses connected to such piracy but, above all, it gives you an emergency hotline to contact IT and legal experts.

In addition to a number of “cyber-risks”, it may offer guarantees for:

- Computer abuse

- Viruses and computer piracy

- Cyber spying

- Data theft

- Blackmail linked to a cyberattack (ransomware)

- Defamation, insults and smear campaigns via the Internet

- Identity theft

> For more information concerning this insurance, you may contact INOV Expat by email at [email protected].

INOV Expat - Who are we?

INOV Expat is an insurance brokerage firm aimed at French and English-speaking expatriates in Portugal and Spain, which has signed partnership agreements with the leading insurance companies on the market. We know just how much moving to another country can bring about a lot of surprises and procedures which are sometimes quite complex.

So, ever since its foundation in 2004, INOV Expat has not only aimed to assist its expatriate clients search for “custom insurance” but also defend their rights in the event of a claim.

Ask for your free online quote: automobile, health, home, business, travel, or other insurance. Contact us by email at [email protected] or by phone +351308809541 or WhatsApp (+351) 910 80 8

![]()