Community insurance in Portugal: Understand everything in 6 questions

Community insurance in Portugal: Understand everything in 6 questions A condominium is exposed every day to multiple risks that require urgent and necessary services to deal with them. It is therefore important to subscribe community insurance in Portugal, here called "seguro de condominio", for the peace of mind of all neighbours. If you want to...Continue reading→

Car insurance: Take out your car insurance in Portugal

Car insurance: Take out your car insurance in Portugal Is car insurance compulsory in Portugal? In Portugal, the only compulsory insurance that exists is third party liability insurance, which is compulsory for any vehicle registered. Car insurance is compulsory in Portugal. Why take out car insurance? Taking out civil liability insurance will enable your insurance...Continue reading→

Life insurance: Is it good to subscribe your insurance with the bank?

Subscribing a life insurance through the bank is not mandatory in Portugal. Since the law nº222/2009, the banks have to say in their mortgage quotes that the client can subscribe a life insurance with another company, as long as the policy matches the requirements of the bank. Life insurance has different goals: Protect your family:...Continue reading→

Pet Insurance : how does Pet Insurance work in Portugal ?

1. Covering civil liability for your pet in the event of material damages or bodily harm caused to a third party In Portugal, your home insurance (not mandatory if you’re a tenant) covers the civil liability of all the occupants of the home including your 4-legged companions, whether cats or dogs. However, since 2003, Portuguese...Continue reading→

Coronavirus COVID-19 : how your insurance is going to help you ?

The Covid-19 coronavirus, originally known as the Chinese coronavirus or Wuhan pneumonia - the city where the epidemic originated - is keeping the world on alert and has caused an unprecedented health crisis, aggravated by its spread outside China all over the world, including Portugal. In this article, we will give you the best advices...Continue reading→

Personal Accident Insurance : Guide in Portugal

Personal Accident Insurance : Guide in Portugal 1- Why should I take a Personal Accident Insurance in Portugal ? a) What is a Personal Accident Insurance ? The personal accident insurance is a personal insurance method which covers risks as disability, death, processing costs of the insured and gives you access to a medical assistance intended to...Continue reading→

Life Insurance in Portugal : everything you need to know

Life Insurance in Portugal : everything you need to know Planning to better guarantee the future of your loved ones means protecting yourself against a disability, for example, that may affect your daily life as well as your loved ones. It also means ensuring the mortgage on your home is paid in the event of death...Continue reading→

Executive Insurance

Executive Insurance Are you a company executive? Have you heard of “D&O” insurance? It’s actually “Directors and Officers” insurance which covers company directors’ and officers’ liability, particularly in the event of a management failure. Here are a few explanations with regard to this insurance... Why take out directors and officers liability insurance? “Each time you...Continue reading→

How does Dental Insurance work in Portugal ?

How does Dental Insurance work in Portugal ? Keep smiling with dental insurance! Everyone knows nowadays that paying attention to oral hygiene is not a matter of how you look, but rather a way to maintain overall health. Yet, the truth is, even if you see it as a health issue, dental care can sometimes...Continue reading→

Cyber Insurance

Cyber Insurance Unless you’re a “geek” and passionate about all things digital, Wannacry and Notpetya are probably names that mean nothing to you. However, they really shook up the information security managers at the largest companies in the world in 2017. They are the names of two new digital viruses (malware) which blocked several companies...Continue reading→

Search

Articles

Guide to Automobile Insurance in Portugal

Index

ToggleGuide to Automobile Insurance in Portugal

To better understand automobile insurance in Portugal, we’d like to first remind you of the principles of automobile insurance and then we’ll give you all the details of the different administrative procedures required before insuring your vehicle.

To protect yourself in the event of an accident, theft or simply a blow to your windshield, automobile insurance gives you the guarantees you need to drive peacefully. Besides insuring the driver and all passengers, automobile insurance also covers the driver’s civil liability for damages caused to third parties.

To drive in a zen state of mind, make sure you’re well-insured!

Insuring your vehicle in Portugal: an obligation?

In Portugal, even insuring your car is subject to the law.

In fact, just like in England or in Spain, for example, Portuguese law requires car owners insure their vehicles with at least “third-party” insurance. This minimum guarantee, also known as “automobile civil liability” covers the costs of any material damages or bodily injuries the driver may cause to third parties. However, there are several options available to complete this basic guarantee and expand the cover for the insured vehicle (see the section “choosing good automobile insurance”).

How is the price of my automobile insurance calculated?

The sum of the premium for your automobile insurance in Portugal depends on the type of guarantees chosen (third-party, standard or all-risk) but also your driving record; in other words: your age, the number of years you have had a licence, your driving history with former insurance companies (bonuses/penalties), the use of your vehicle in Portugal.

Did you know?

If you have lived in a European country for at least 6 months, you can take a driving exam... it’s easier to pass your exam in Portugal than in France and it costs less!

And for those who still don’t speak Portuguese, some driving schools offer driving courses in French (for a higher fee): the practical exam, however, will be in Portuguese!

How do you insure your vehicle?

1st step: change the plates...

Now living in Portugal, you wish to keep your favourite car: your old insurance may cover you for a maximum of 3 months. So, you need to take advantage of this period to apply to change your registration plates with the Portuguese authorities. We’ll give you all the details on the different steps, which sometimes require a little patience... (private intermediaries, however, can do this work for you for a fee of around €500).

- Obtain the certificate of conformity (builder’s site)

- Complete an IMT form 9 (downloadable doc in Portuguese)

- Take your vehicle to pass a technical inspection (authorised centres)

- Apply for approval of your vehicle (through the IMT office closest to your place of residence)

- Legalise your vehicle and pay ISV (vehicle tax) – A customs office corresponding to your place of residence

- Apply for a new grey card (IMT)

- Register your new registration plates with the Conservatoria do registo Automovel

2nd step: choose good automobile insurance

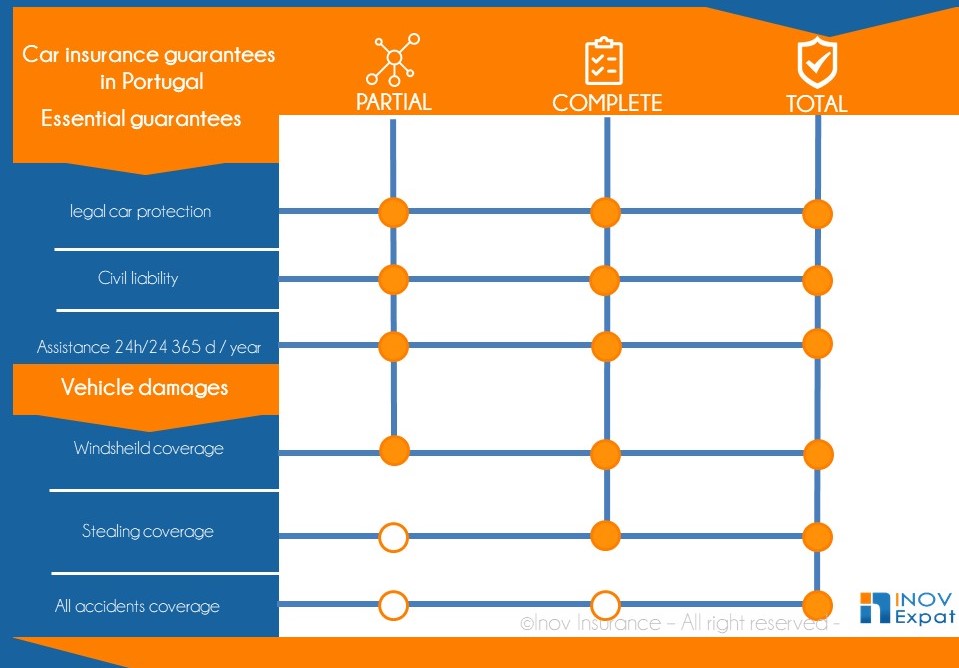

The automobile insurance policies you’ll be offered may be divided into 3 major categories: Basic-Standard-All risk :

3rd step: Documentation

To take out an automobile insurance policy in Portugal, you must provide the following documents to your insurance company or broker

- Taxpayer’s ID number (Numero de contribuinte)

- A mailing address in Portugal

- A bank account number in Portugal

- Your driving history with bonuses/penalties (ask your former insurance company)

- The grey card for your vehicle now registered in Portugal or the official documentation proving you’ve applied for a change of registration through the Portuguese authorities.

INOV Expat - Who are we?

INOV Expat is an insurance brokerage firm aimed at French and English-speaking expatriates in Portugal and Spain, which has signed partnership agreements with the leading insurance companies on the market. We know just how much moving to another country can bring about a lot of surprises and procedures which are sometimes quite complex.

So, ever since its foundation in 2004, INOV Expat has not only aimed to assist its expatriate clients search for “custom insurance” but also defend their rights in the event of a claim.

Ask for your free online quote: automobile, health, home, business, travel, or other insurance. Contact us by email at [email protected] or by phone +351308809541 or WhatsApp (+351) 910 80 8

![]()