Personal Accident Insurance : Guide in Portugal

Yohan Leuthold2025-04-02T10:28:50+00:00Index

TogglePersonal Accident Insurance : Guide in Portugal

1- Why should I take a Personal Accident Insurance in Portugal ?

a) What is a Personal Accident Insurance ?

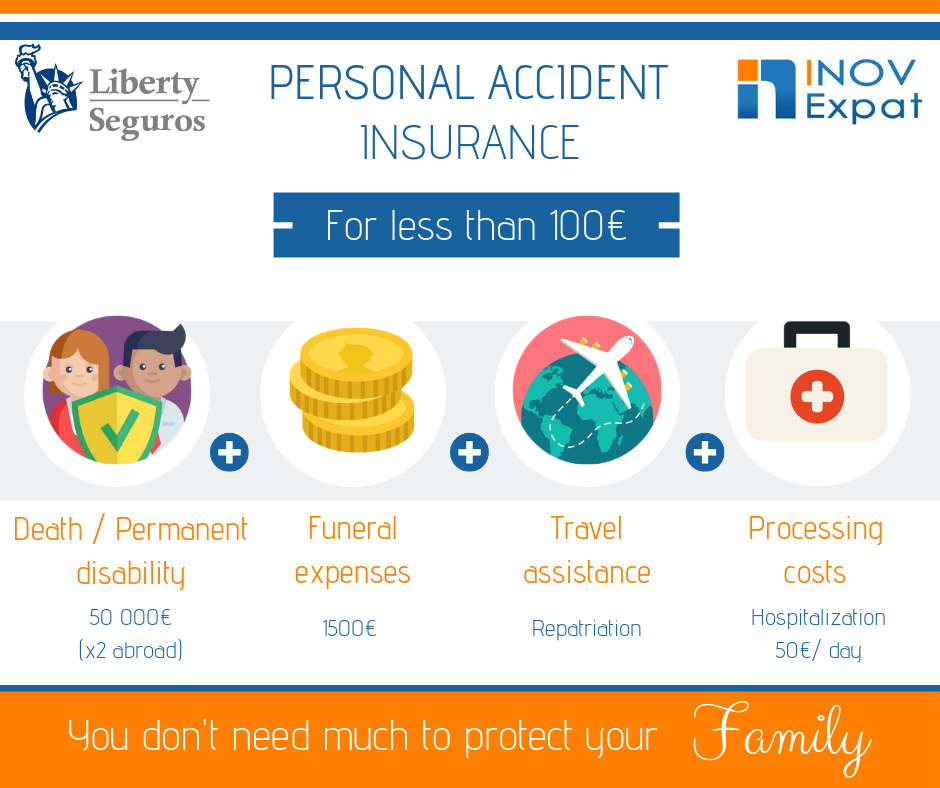

The personal accident insurance is a personal insurance method which covers risks as disability, death, processing costs of the insured and gives you access to a medical assistance intended to cover hospital fees in Portugal, in case of an accident.

b) Who is covered by my Personal Accident Insurance ?

Suscribe a Personal Accident’s Insurance might be a real advantage for your tranquility, the one of your family and your financial security.

Besides ensuring economic security to the insured at a fair price, the Personal Accident’s Insurance allows to cover the entire group of people that directly depends of the insured if this one comes to die.

c) How can I calculate my Personal Accident’s bonus?

Considering that the risk of an accident is the same for everyone, the bonus will be identical whatever your age. So, the bonus is fix!

2- How work my Personal Accident Insurance?

a) In case of death of permanent disability

In case of death, the sum insured will be reversed to beneficiaries figuring on the contract. If there are no beneficiaries mentioned, the sum will be reversed to legal successors.

In case of permanent disability, will be reversed the % of the sum insured taking into account the devaluation table.

b) In case of temporary disability and hospital admission ?

The insurer pays the daily allowance set during the hospital stay or the clinic stay, for a time never above 360 days.

3- Processing costs

a) What are processing costs?

Processing costs are medical and hospital fees, including medecine costs and infirmary fees.

b) What should I do in case of a regular clinic treatment?

In case of a regular clinic treatment, are included delocalization fees of the insured to the doctor, the hospital, the clinic or the infirmary care station, as long as the mean of transport used is the adequate one.

c) How to get reimbursed for your processing costs?

The reimbursement of costs is done upon presentation of valid documentary.

d) Reimbursement of funeral expenses

Reimbursement until the quantity set in funeral expenses’s particular conditions of the insured.

4- Medical assistance in Portugal and medical assistance Abroad.

a) Medical assistance in Portugal

Below are different points that supports the medical assistance in Portugal:

- Hospital Admission

- Ambulatory Assistance

- Search and send of medecines

b) Medical assistance Abroad

Below are different points that supports the medical assistance Abroad:

- Medical transportation of repatriation of the injured and/or sick

- Accompaniment during medical transportation of repatriation

- Accompaniment of the hospitalized insured

- Round-trip ticket for an insured relative

- Extension of the stay at the hostel

- Medical, surgical, pharmaceutical and hospitalization fees abroad

- Repatriation or transportation of the deceased person and companions

- Luggage theft abroad

- Cash advance

- Trip cancellation

- Delay for luggage reclaim

- Flight delay

- Loss of airline connection

- Loss of flight for public transports reasons

- Legal Assistance abroad

c) Theft, loss or deterioration of luggages during the travel

In this case, the insurance includes the payment of damages caused to the luggage for theft, loss or deterioration.

However, the insurance does not refund:

- Cash, cheques, credit cards, all kind of documents, travel tickets

- Jewellery, watches and other objects made of metals and precious stones

- Art pieces and collections

- Fur coat

- Cellphones, laptops and their respective accessories

- Photo camera and camera

- Fragile goods

- Prosthetics or Orthotics

d) What is my capital insured in case of theft, loss or deterioration ?

The capital is 1.250€ with a sub-limit of 250€ per loss or damages items.

The word of INOV : “I always advice my clients to subscribe a Personal Accident Insurance. It is not mandatory but can be very useful if you face the unexpected. It can facilitate the life of the insured as the one of his family in case of accident.” - Benjamin Retali

INOV Expat - Who are we?

INOV Expat is an insurance brokerage firm aimed at French and English-speaking expatriates in Portugal and Spain, which has signed partnership agreements with the leading insurance companies on the market. We know just how much moving to another country can bring about a lot of surprises and procedures which are sometimes quite complex.

So, ever since its foundation in 2004, INOV Expat has not only aimed to assist its expatriate clients search for “custom insurance” but also defend their rights in the event of a claim.

Ask for your free online quote: automobile, health, home, business, travel, or other insurance. Contact us by email at [email protected] or by phone +351308809541 or WhatsApp (+351) 910 80 8

![]()